As we embark on a new year, it is always useful to look back at events over the previous twelve months. The year began with markets still dominated by the artificial intelligence (AI) theme, but with growing unease around concentration and valuations. Early enthusiasm was punctured briefly by concerns that rapid progress outside the US, most notably China’s DeepSeek model, could erode the perceived dominance of a small group of AI leaders. That episode faded quickly, but it set the tone for a year in which market leadership was repeatedly questioned.

The DeepSeek impact on Nvidia’s share price

By late February, attention shifted more squarely to policy risk. A slowing US growth outlook, sticky inflation and the prospect of renewed protectionism under a second Trump presidency made markets increasingly sensitive to trade headlines. The US market’s narrow leadership became a source of fragility rather than strength, particularly for sterling-based investors, as any wobble in US mega-caps was amplified by currency moves.

April marked the clearest rupture of the year. Speculation about Trump's trade plans had already started to spook markets, but the “Liberation Day” tariff announcement triggered a sharp sell-off at the start of the month. Uncertainty, rather than tariffs themselves, became the dominant issue. Supply chains, investment plans and corporate margins were all thrown into question, while concerns resurfaced around US fiscal sustainability and political pressure on the Federal Reserve. Although markets stabilised after tariff pauses were announced, the episode served as a reminder of how quickly policy risk can reprice assets.

Trump’s tariffs – speculation then reality

Through late spring and early summer, markets oscillated between relief and renewed anxiety as trade negotiations were delayed, challenged and reworked. Risk appetite gradually rebuilt, helped by central banks signalling caution rather than urgency, but the recovery was uneven. Diversification proved valuable, as markets outside the US were less exposed to the same degree of concentration that characterised American indices.

By mid-year, attention returned decisively to AI. Capital spending concerns gave way once again to optimism, and a small group of firms reasserted control over index returns. Relief rallies followed trade agreements with Japan, the UK and eventually the EU, but the pattern was familiar, gains were strong, but narrow.

The final months of the year saw global markets push to new highs, yet with increasingly demanding expectations. Earnings season became less forgiving, particularly for companies spending heavily to defend their position in AI. Even strong results were not always enough, reinforcing how stretched sentiment had become around a small set of market leaders.

Taken together, 2025 was defined less by a single lasting shock and more by repeated stress tests of confidence. Tariffs, geopolitics and policy uncertainty repeatedly challenged markets, but each time the AI-led growth narrative re-emerged. The result was a year of strong headline returns, but one where concentration, valuation discipline and diversification mattered more than at any point in the cycle.

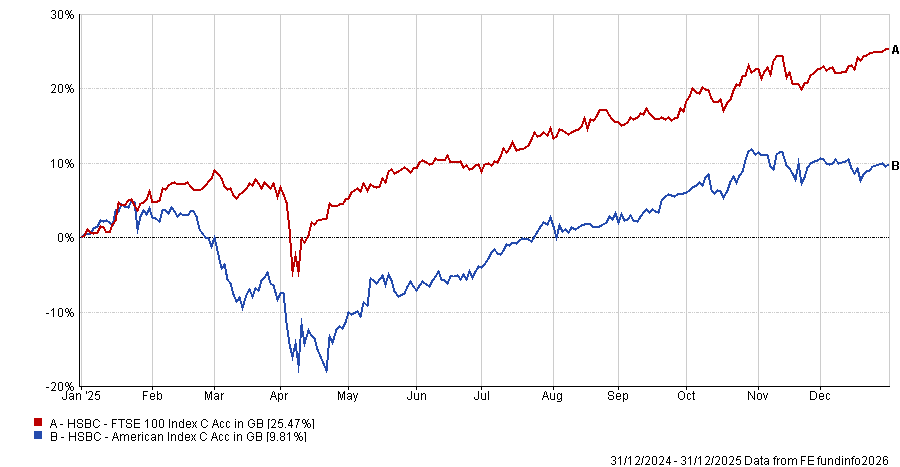

As noted above, currency movements were also key from our perspective as UK investors. A fund tracking the main US market finished the year up in the region of 18% in US dollars but just 9.81% when converted to sterling. Meanwhile, a fund tracking the main UK index was up over 25% in 2025.

Home versus Away

Looking ahead, it seems likely that the AI theme will remain key this year, for good or ill. Vast sums of money have been bet on success of the technology and investors are increasingly urging the big spenders to come good on their promises. If they do, and AI becomes the era-defining technology that many expect, then we could see the valuations of the big tech firms rise yet further but we might also witness the emergence of a new cadre of companies who employ AI in innovative ways.

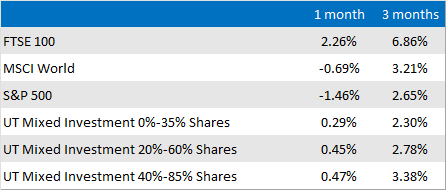

Outside of this, inflation and central bank policy will likely stay in focus. We saw UK markets rally in December after inflation fell by more than had been expected. This increased speculation about an interest rate cut which arrived at the end of the year, mirroring the cut that the Federal Reserve had enacted a few weeks earlier. Looser monetary policy and the cheaper debt that comes with it could be another important driver of returns in 2026.

Market and sector summary to the end of December 2025

Source: Financial Express Analytics.

Past performance is not a guide to future performance, nor a reliable indicator of future results or performance.