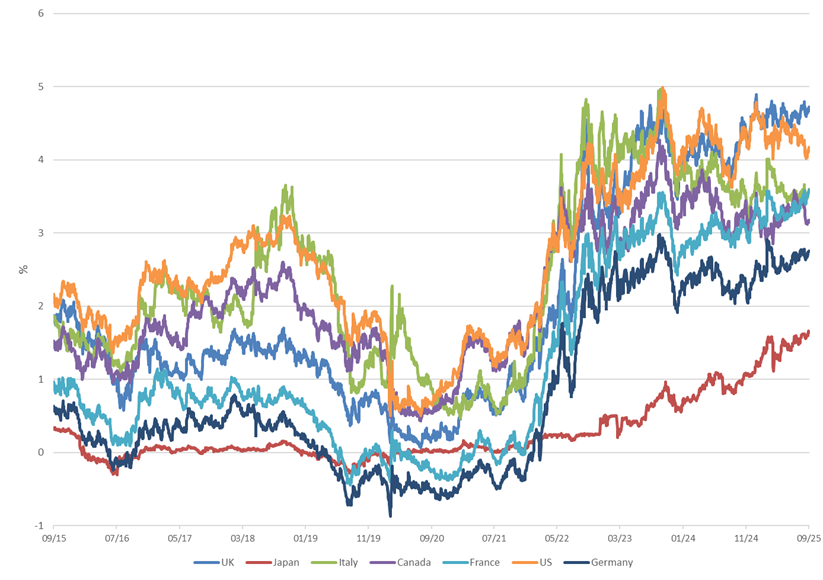

One of the year’s main themes has been the somewhat dull but nonetheless important issue of steadily rising government borrowing costs, and September saw this trend gather pace. In the UK, 10-year gilt yields moved above 4.7%, a level not seen since the late 1990s. Despite attempts from some quarters to suggest this is a UK-specific problem, other major countries have followed the same path.

France’s borrowing costs leapt to the highest rate since 2009 after a series of political crises culminated in a ratings downgrade. In Japan, long-dated bonds rose to record levels as speculation grew that the Bank of Japan would start to raise interest rates, increasing costs for the government. Meanwhile, in the US 30-year yields briefly tipped over 5%, not far off the highest point in 15 years.

James Carville, a US political strategist, once said that he wanted to be reincarnated as the bond market because then "you can intimidate everybody”. Governments, no matter their size, are beholden to the people buying their debt. After decades of easy lending to governments, investors are now demanding higher returns as countries move ever further into the red.

Yields on 10-year government debt in G7 countries

Source: Factset

At the same time, inflation remains a challenge, especially in the UK where CPI has risen to 3.8%. This is the highest of the major economies, with pressure concentrated in everyday essentials such as food, fuel and hospitality. In the US, inflation hit 2.9% having moved higher in August. Growth looks very different across regions: the UK remains sluggish, with GDP up only 0.3% in the second quarter of this year, while the US economy has been far more resilient. These divergences explain why central banks are taking very different paths.

The Federal Reserve (Fed) recently made its first move since December, cutting rates by 0.25%. The decision was widely expected, with markets having already priced it in, and consequently the reaction was muted. Some investors had speculated about a larger cut, and expectations now point to another 0.5% of easing over the rest of the year. Historically, the first cut has often paved the way for strong equity performance in the following twelve months, though with US equity markets already so expensive, it will be interesting to see if that pattern is able to repeat itself.

The trigger for the Fed’s action was weak employment data, with payroll growth slowing and unemployment edging higher. Officials described the move as a “risk management cut”, aimed at heading off further deterioration. Tariff-related price pressures are seen as temporary, but a weakening labour market is more difficult to ignore.

The politics, however, are where the story arguably becomes more interesting. As discussed in last month’s update, President Trump has made repeated attempts to exert influence over the Fed. His efforts to remove Governor Lisa Cook failed after her appeal was upheld (for now at least), but he did manage to secure Senate approval for his adviser Stephen Miran, who cast the only dissenting vote in September’s meeting. Trump has openly argued for rates to be cut much more quickly to reduce America’s debt burden, even as he continues to insist the jobs market is strong.

The Bank of England, meanwhile, had little room to follow suit. Rates were left at 4%, reflecting a view that inflation remains more persistent than elsewhere and that growth has barely moved. Productivity forecasts from the Office for Budget Responsibility are set to be revised lower, with downgrades that could wipe out up to £18bn a year in fiscal headroom.

As a result, the upcoming Autumn Budget will be delivered against an awkward backdrop. Hopes for tax cuts or fresh spending will be constrained by the realities of higher borrowing costs and less fiscal space. Even small adjustments to the forecasts now carry big implications, reducing the Chancellor’s flexibility at a politically sensitive time.

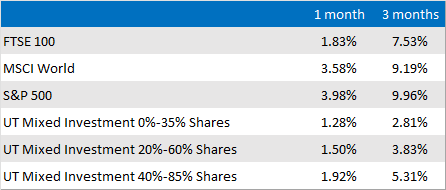

Despite these challenges, equity markets have taken events in their stride. The summer rally carried through into September, with indices such as the US S&P 500 & Nasdaq, Japanese Nikkei and even our own FTSE 100 all at or near record highs. The technology sector continues to dominate, with Alphabet becoming the fourth company to surpass a $3 trillion valuation. As we highlighted when discussing NVIDIA’s meteoric rise, it wasn’t that long ago that hitting $1 trillion was seen as a remarkable feat.

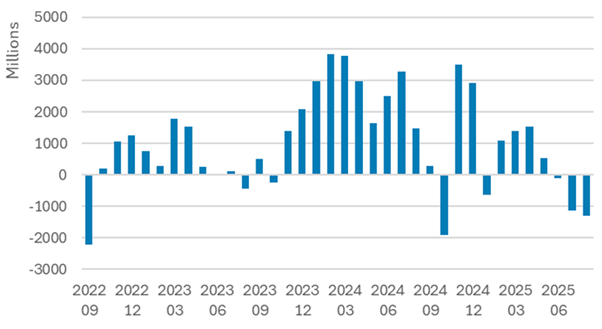

Despite this, or more likely because of this, investors themselves have become more cautious. Confidence surveys show sentiment weakening across regions, with the sharpest falls seen in attitudes towards American equities. August also saw the second largest equity outflow since 2022, with £1.3 billion withdrawn.

Equity fund flows

Source: Calastone

Part of this caution reflects concerns that valuations are growing increasingly stretched, with the concentration in the biggest companies continuing to grow. Recent problems in US credit markets reinforced this nervousness with two firms running into trouble over excess debt. In isolation, events like this can be written off, but the proximity of both failures has raised questions about how much risk has built up in areas of the debt market that many assumed were secure.

UK equities stand out in this environment. Despite lacklustre domestic growth and fiscal concerns, the market is on track for its strongest year in decades. Retail allocations show renewed interest, reversing years of steady outflows. This is a reminder about how important it is to look past headlines.

Looking ahead, the near-term is likely to be dominated by data. Every inflation print, employment release and central bank statement will be scrutinised for clues about what the future might hold. Equally, geopolitical risks remain ever-present, but for now they have not derailed the positive trend. Indeed, markets have been quick to shrug off any bad news, though with valuations high and sentiment cautious, the margin for disappointment is slim.

Market and sector summary to the end of September 2025

Source: Financial Express Analytics.

Past performance is not a guide to future performance, nor a reliable indicator of future results or performance.