Thank you to everyone who has already responded to the latest review of the IMS portfolios which was sent out last month. We’ve had an excellent response so far, but if you have not yet had an opportunity to send us your acceptance, we would be grateful if you could so that we can make sure your investments are in the latest fund selection. You can respond to this message if you would like another copy of the review to be sent out.

The main story of the month was arguably not the latest news on Donald Trump’s global trade war, or the real wars that continue to rage, but the seemingly more prosaic topic of central bank independence. The Federal Reserve, the US central bank commonly known as the Fed, is responsible for setting interest rates and its decisions have far-reaching influence. The rates they set have a knock on effect on borrowing costs for the US government and households, they affect the strength of the dollar, and they ultimately drive the performance of global markets. For that reason, independence from political interference has long been treated as a cornerstone of financial stability.

That principle is now being tested. President Trump has sought to remove a sitting Fed Governor, a move that would give the White House direct influence over monetary policy. He has long accused the Fed of holding back growth and has repeatedly attacked its members with accusations of incompetence or worse. The irony is that his aim is to force lower interest rates so that the US government can borrow more cheaply in order to fund his ambitious spending agenda. Yet by undermining the Fed’s credibility, he risks achieving the opposite: if investors lose faith in its independence, they may demand higher returns for lending to the US, pushing borrowing costs up rather than down, regardless of what the Fed chooses to do.

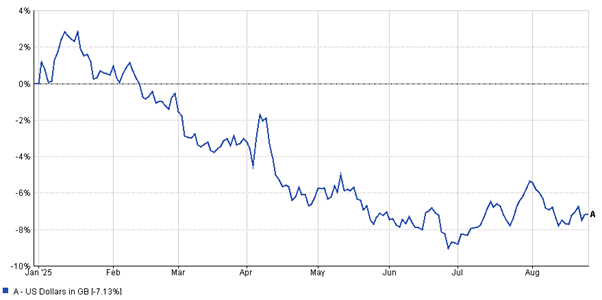

US dollar continues to weaken

Source: Financial Express Analytics

Fed Chair Jerome Powell used a speech at a recent meeting of the world’s major central banks to defend his institution’s role while also signalling a shift in approach. He reaffirmed the 2% inflation target but stressed that policy would be applied more flexibly, with the possibility of rate cuts if tariffs and weaker growth begin to bite. That reassurance has so far kept markets calm, but the larger risk is clear. If confidence in the Fed’s independence erodes, the stability of the dollar and wider trust in global markets could quickly come under strain. Some senior market commentators have already drawn comparisons with countries like Turkey where governmental meddling in central banks led to much higher borrowing costs.

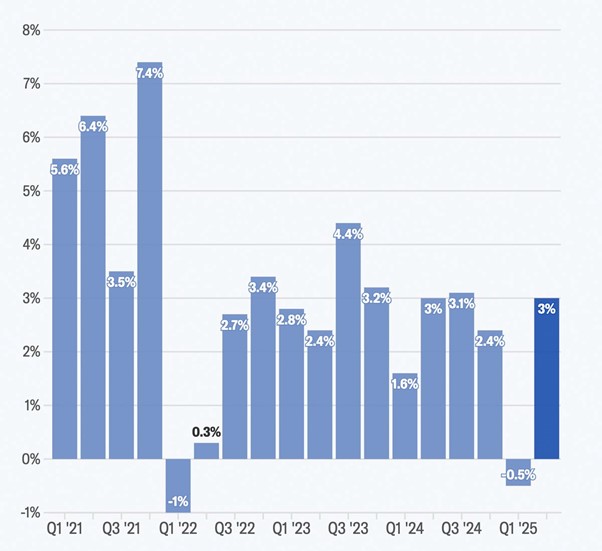

For good reason there is very little historical precedence for a Fed Governor being fired by a president, so the matter will likely be tied up in the courts for some time. With the Fed dominating financial headlines, US economic data offered a more reassuring picture. Second quarter GDP showed a clear rebound, up 3% versus the fall experienced in the first three months of the year.

US GDP rallies

Source: Bureau of Economic Analysis

What is unusual is how little reaction there has been from either forecasters or markets to recent events. Political interference at the Fed, a slowdown in the employment market, and escalating tariffs might have been expected to unsettle investors. Instead, markets appear remarkably calm, with many assuming that growth will remain intact and that monetary policy will simply adjust as needed.

The calm in markets also sits oddly against the backdrop of Trump’s Liberation Day tariffs. The latest high-profile flashpoint has been India, which was hit with sweeping 50% penalties after continuing to buy discounted Russian oil. Recent reports suggest that Prime Minister Modi has refused to take President Trump’s calls, highlighting how the dispute has quickly escalated into a broader diplomatic standoff after years of US diplomatic efforts to improve relations with one of the fastest growing big economies.

Alongside this, dozens of countries including most of Europe as well as others such as Japan and New Zealand have suspended parcel deliveries to the US ahead of new import taxes which came in at the end of the month. The removal of the exemption on low-value parcel deliveries may sound like a relatively minor story given some of the headline-grabbing news, but it has already created serious difficulties for smaller companies that rely on international shipping to reach customers.

Taken together, these measures underline how wide-ranging the tariff regime has become. What began as a series of bilateral disputes has grown into a trade war that now touches everyday commerce as well as major geopolitical relationships. The longer-term consequences are likely to be felt through higher costs for businesses and consumers, disrupted supply chains, and a greater risk that inflation remains elevated for longer than expected. These pressures may not be fully visible in markets today, but they will shape the global economic backdrop in the months and years ahead.

As investors, the challenge for us is to look beyond the noise of daily headlines and focus on what truly shapes long-term outcomes. Central bank policy, trade disputes and shifting political dynamics will continue to create periods of uncertainty, but they do not change the core principles of investing. Our long-term valuation discipline while maintaining balanced and diversified portfolios remains the best way to navigate an environment where short-term market calm can mask longer-term risks.

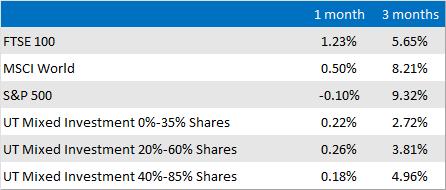

Market and sector summary to the end of September 2025

Source: Financial Express Analytics.

Past performance is not a guide to future performance, nor a reliable indicator of future results or performance.