With the situation in Iran continuing to evolve, it is regrettably necessary to begin another update by noting that this commentary discusses the impact of recent events on the global economy. This is not the place to dwell on the human cost of the latest conflict to feature in these pages and, as ever, we hope for a quick and peaceful resolution.

Donald Trump initially suggested he would take two weeks to decide whether to assist Israel with its attacks on Iran. He described the precision strikes as having caused “monumental damage” and not long afterwards the White House was having to clarify his comments about the idea of regime change in Iran.

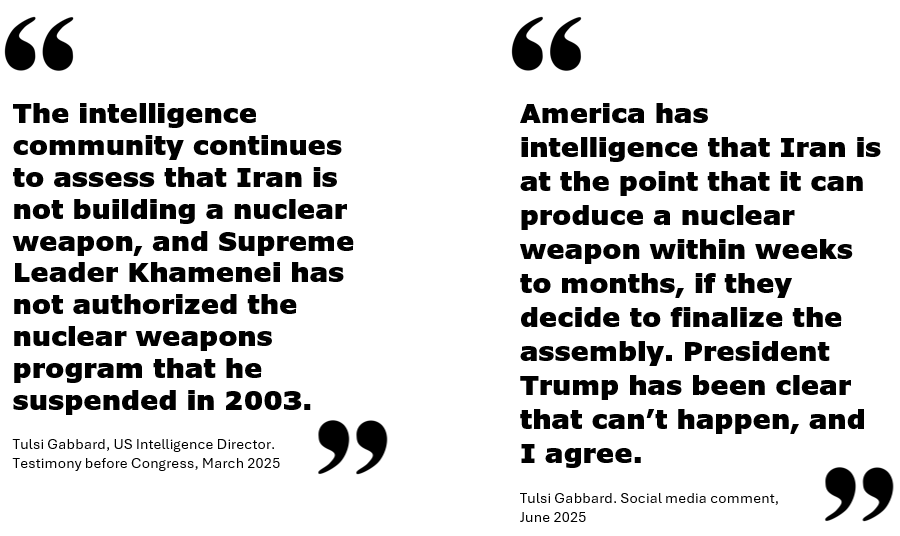

Prior to the US intervention, many of his fellow Republicans were trying to find tactful ways to warn him about the risks of becoming entangled in another war in the middle east. Some also questioned the justification, legal and factual, for such action. As recently as March his director of national intelligence, Tulsi Gabbard, had testified before Congress that Iran was not close to building a nuclear weapon. When made aware of this, Trump simply said that she (and by extension the US intelligence community) was wrong.

It’s worth quoting Gabbard’s response to being so thoroughly undermined. It highlights how Trump’s view is the only one that matters. When those around him are so keen to stay in his favour, it creates an environment where unpredictability becomes the norm.

The strikes were a strange move for a man who has long professed a desire to keep America out of foreign wars. Perhaps the reversal of his isolationist stance was that he didn’t like being told what to do by those around him, or maybe he was fed up with everyone calling him a chicken (see last month’s update). There is speculation that he saw this as an opportunity to prove his mettle, despite the apparent hypocrisy of the move.

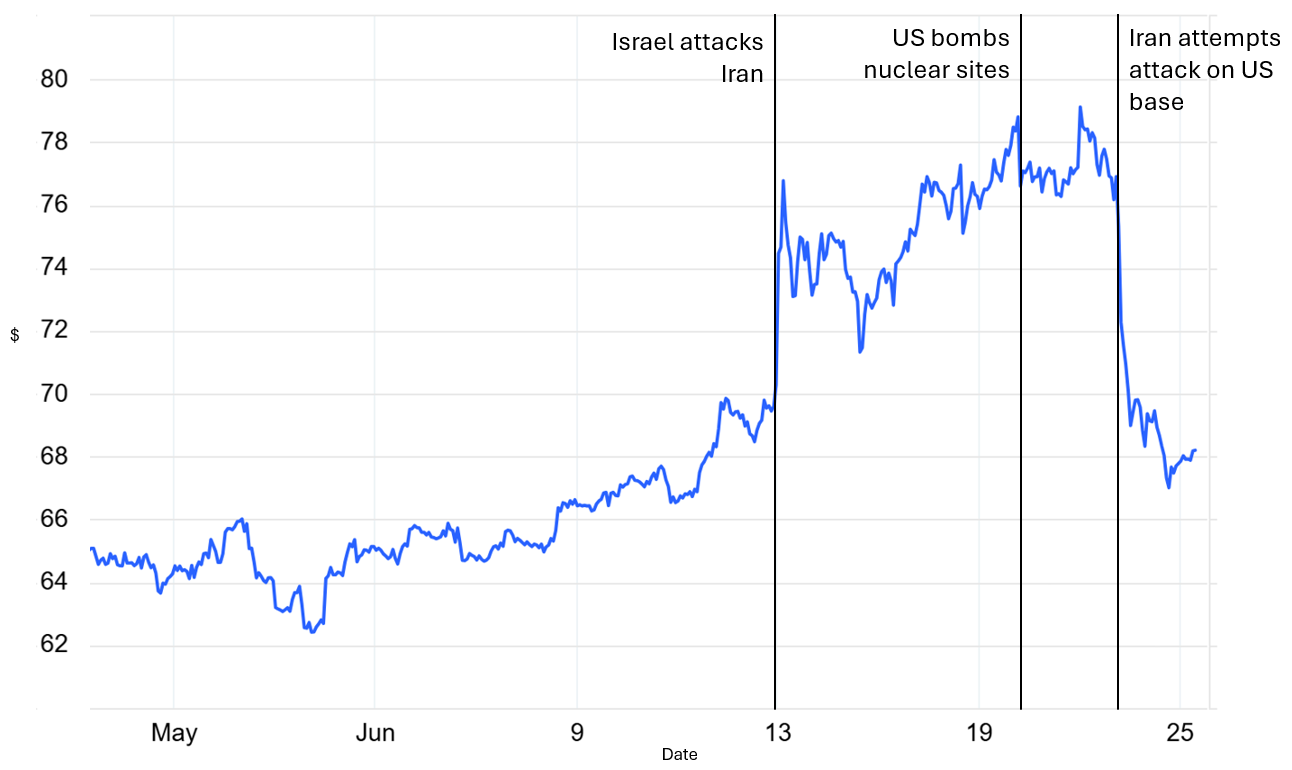

Given the potential ramifications, the initial market reaction was perhaps milder than might have been expected. Major indices dipped slightly and oil prices moved higher, though only to levels last seen earlier this year. This was partly because Iran represents a much smaller share of global oil production than in previous conflicts: in 2023, the US accounted for 20% of global supply, while Iran produced just 4%.

There appeared to be an unofficial understanding about who and what could be targeted. Israel focused on Iran’s domestic infrastructure and, despite clearly having excellent field intelligence, refrained from targeting Ayatollah Khamenei, Iran’s supreme leader. In exchange, Iran avoided disrupting the Strait of Hormuz, one of the world’s most strategically important trade routes through which some 30% of oil supplies are transported.

At the time of writing, a fragile ceasefire seems to be holding. Iran’s response to the US bombing was limited to a highly telegraphed and easily thwarted attack on an American military base in Qatar. The assumption appears to be that the strikes eliminated Iran’s nuclear capability, though questions remain about its existing uranium stockpiles.

Oil prices quickly retreated on the news that hostilities had been paused. Alongside one of the biggest one-day drops in crude prices in several years, equity markets also rallied. This echoes the pattern seen over recent months. As mentioned in last month’s update, markets continue to ‘sleepwalk’, eager to move on from each fresh concern. Or perhaps investors have simply become desensitised to the noise, accustomed to brief pullbacks followed by swift recoveries.

Oil prices rapidly recover

Source: Brent Crude oil prices, month to 25/6/25

While we continue to monitor events in the middle east, there are also some other developments which are worth highlighting.

Central banks have a tricky job at the best of times, trying to balance a number of priorities to keep their respective economies on the right track. This is made much more difficult when events so frequently shift without warning. In the US, the Federal Reserve elected to leave rates unchanged after a unanimous vote. Trump and his allies were quick to criticise the lack of action, however, employment data continues to improve and inflation remains above target so being boring seems like a pretty sensible move.

The Bank of England (BoE) also kept rates unchanged, at 4.25%. The vote wasn’t quite as one-sided, with three members opting for a 0.25% cut. UK inflation was slightly lower at the latest reading but at 3.4% it is still miles ahead of the BoE’s target. Within this number, food inflation rose to 4.4% in May with chocolate prices rising at a record rate.

In an attempt to move the conversation on from talking about dire conditions and desperate measures, the UK government recently announced a long-term plan to target eight “high growth” sectors. An independent body will monitor the progress of the 10-year strategy which seeks to address some of the structural issues which the government believes have held back the country. UK GDP fell by 0.3% in April, a larger drop than had been expected and a big reversal of the 0.7% seen in the first quarter of the year, so there is clearly work to be done.

One piece of good news for Rachel Reeves and her efforts to balance the UK’s books came from a slightly unusual source. It was revealed that a £500m “patriotic gift” was donated to the government's coffers in the 2024-2025 period. The gift was the proceeds of a fund set up nearly a century ago by a prominent banker and takes the amount the government has received in the last two years to over £1bn. With public sector debt reaching levels not seen since the 1960’s, Reeves and co will take all the help they can get.

In another positive development, it was announced that the US and UK formalised a trade deal which is set to benefit some of our key manufacturing sectors. This makes us the first country to secure a deal since Liberation Day which helps to justify the very passive approach taken by Keir Starmer towards the mercurial US president.

The subject of tariffs is likely to be back in the news in the near future as Trump's 90-day pause comes to an end not long after this update goes out. We can no doubt look forward to another period of heightened volatility and will do well to remember that we’ve all been down this road before. Our focus remains firmly on the long-term picture.

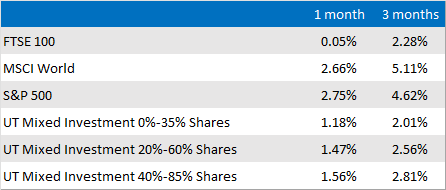

Market and sector summary to the end of June 2025

Source: Financial Express Analytics.

Past performance is not a guide to future performance, nor a reliable indicator of future results or performance.