Thank you to everyone who has already responded to the latest review of the IMS portfolios which was sent out last month. We’ve had an excellent response so far, but if you have not yet had an opportunity to send us your acceptance, we would be grateful if you could so that we can make sure your investments are in the latest fund selection. You can respond to this message if you would like another copy of the review to be sent out.

The main story this month continues to be the US administration’s stance on trade. President Trump’s latest round of tariffs - dubbed Liberation Day 2.0 - were dealt a blow at the end of May after a federal trade court ruled that they exceeded presidential authority. The court’s judgment placed many of the proposals in legal limbo, but a federal appeals court has now granted a temporary stay, allowing the tariffs to remain in place until further notice and adding to the state of befuddlement about the whole situation.

This uncertainty matters not just for geopolitical relationships, but also for the US economic outlook, as the tariffs were expected to contribute towards funding the president’s One Big Beautiful Bill Act (yes, that is its actual name) - a sprawling package of tax cuts, infrastructure projects, and the odd voter-pleasing handout.

Much like tax cuts from Trump’s first term, which this bill seeks to make permanent, the result will be a big jump in government borrowing. It has drawn criticism from both ends of the political spectrum and only passed the first voting stage by a single vote. Elon Musk, fresh from quitting his much hyped but ultimately ineffective role at the Department of Government Efficiency, said that he was disappointed with the bill as it increases the US budget deficit. Democrats have widely slated the bill with Chuck Schumer calling it a “cruel and dangerous scheme”.

Some commentators had assumed the White House might pivot away from the deficit risk once the court ruling came through, but the opposite has happened: the bill is being pushed even harder, with key supporters suggesting that it’s too important to delay, and that “workarounds” to the tariff ruling are being explored. For markets, this keeps alive the possibility of wider trade disruption, even if legal rulings eventually cut off the tariff route.

A costly Bill

Source: Guardian via Tax Policy Centre/Tax Foundation

Prior to the latest court shenanigans, the news on tariffs had been decidedly mixed. European shares were boosted by the news that a call between Trump and the European Commission President saw them agree to a further delay in the proposed 50% hike with negotiations extended to the start of July. Conversely, talks with China have apparently stalled with the US president accusing Beijing of “violating” the truce they had previously agreed.

The acronym TACO (Trump Always Chickens Out) has been growing in popularity over the month as investors have become familiar with Trump’s tactic of making a dramatic announcement before quickly reversing course. When quizzed about this recently, the dealmaker in chief seemed surprised that people were being so mean to him, insisting that it’s all just negotiating. In his words, “you set a number at a ridiculous high number and then go down a little bit”. The frustration is that this has been well understood for some time; we all know it, but markets (over)react every time each utterance is made only to rally a few days later.

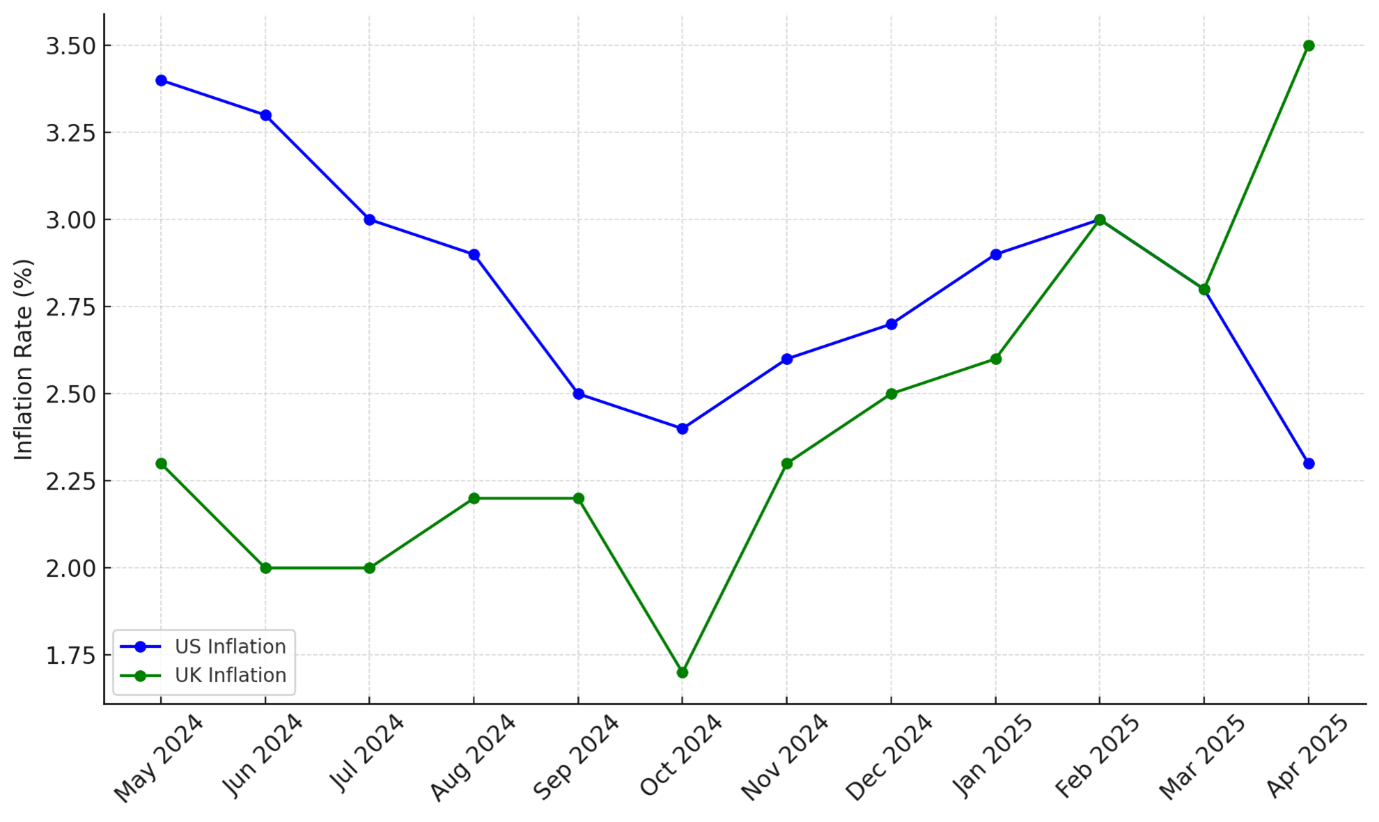

While the political theatre continues, inflation data has taken a more encouraging turn, at least for now. The US inflation number used by the interest rate setters at the Federal Reserve (Fed) rate fell to 2.1% in April, lower than March’s rate and below expectations. This reignited talk of interest rate cuts in the second half of the year, with futures markets now pricing in a near 70% chance of a September move. However, the Fed rightly remains cautious given the amount of ambiguity about the impact of tariffs on future price rises.

The UK is on quite a different path. The April reading was 3.5%, some way above the Bank of England’s (BoE) 2% target. The spike was largely the result of a number of one-off factors such as the rise in National Insurance and minimum wage, as well as water and fuel bills rising. Core inflation remains sticky and wage growth is still uncomfortably high for the BoE, but there is an argument that rates should continue to fall with global growth being dampened by trade tensions.

UK and US inflation – a temporary divergence?

Source: ONS/Bureau of Labor Statistics

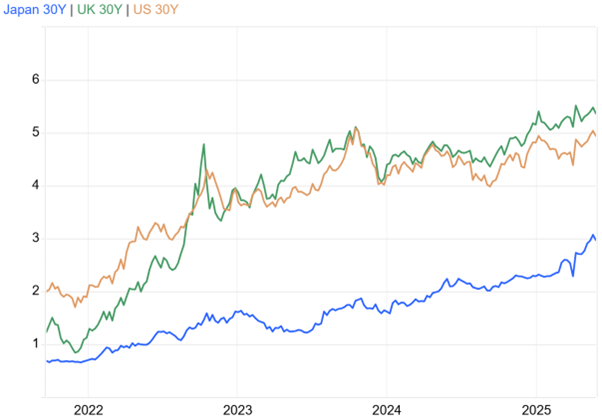

We also need to talk about the rather dull but important subject of government debt. Until recently, investors didn’t seem too concerned about rising borrowing levels in many developed countries, but that’s starting to change. In Japan, government bond yields have jumped in recent weeks, with the 40-year version hitting its highest ever level - a warning sign that even countries with decades of ultra-low interest rates are beginning to feel the pressure.

It’s a similar story in the US, where the return investors demand for lending to the government over 10 and 20 years has been edging higher. A recent bond auction drew a lacklustre response, with buyers demanding a bigger premium to take on the risk. The situation wasn’t helped by the ratings agency Moody’s downgrading America’s credit rating and some of the biggest banks are warning that the current pace of issuance may be unsustainable. That matters because the US is set to ramp up spending on defence, industrial policy and energy infrastructure - the bills are getting bigger just as investors are becoming more cautious.

The UK is also under the spotlight after the International Monetary Fund warned that debt levels were on an “unsustainable path” unless tough choices are made on spending and taxes. The government is trying to thread the needle when it comes to its fiscal rules, but as the recent capitulation on winter fuel bills shows, the pressure is on to balance competing priorities. Issuance of new debt has recently focused on shorter-term options because, as in the US, investors are demanding a greater reward to compensate them for lending money over longer periods because they’re not sure what their money will be worth in the future.

30 year borrowing costs for the UK, US and Japan

Source: Trading Economics

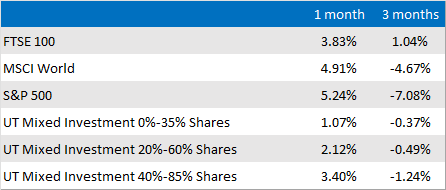

Against this backdrop, equity markets have remained surprisingly resilient. US indices have recovered from their early-April wobble and are back within touching distance of all-time highs. The technology sector continues to do most of the heavy lifting (boosted by bumper returns for chipmaker Nvidia), though the rally has broadened slightly in recent weeks as stocks in other sectors caught a tailwind from the improving inflation picture. Arguably this is a case of investors resorting to muscle memory, drifting back to old habits and investing into familiar stocks.

Perhaps events earlier in the year were all a storm in a teacup, or maybe markets are sleepwalking into trouble. Given everything we’ve seen over the last few years, from global lockdowns to AI manias to banks being replaced by billionaires as economic advisers, it seems unwise to bet on smooth sailing. The tariff saga is far from over, and even if the courts eventually shut it down, the damage may already have been done.

Of course, uncertainty is part and parcel of investing in global markets. The speed of recent recoveries highlights the risk of trying to time our investments so we remain focused on building portfolios that are designed to navigate a range of conditions and on our diversified and disciplined approach. Markets may lurch in response to the latest political spat or economic data point, but the long-term plan is where the real value lies.

Market and sector summary to the end of May 2025

Source: Financial Express Analytics.

Past performance is not a guide to future performance, nor a reliable indicator of future results or performance.