Depending on when you open this email, the election results might already be in and you'll now know which party will be in charge of the country for the next five years. If you're quick and read this before the results start to come in on Thursday, the truth is you probably already know who will be inheriting arguably the worst economy since the Second World War.

At the start of last month, Nigel Farage shocked us/confirmed the inevitable (delete as appropriate) when he announced that he would be standing for parliament in Clacton. Since then we've had polls which put his Reform party (Ltd) ahead of the Conservative and Unionist Party, thanks in no small part to the Tories’ continued foot shooting. This does nothing to help Rishi Sunak’s woes, but it doesn't seem likely to dent Labour's chances of winning a sizeable majority come 4th July. (NB: no matter the size of the victory, it won't be a super majority as some are saying as that concept doesn't exist in the UK.)

As a result of our First Past the Post electoral system, that majority will allow Labour to dominate the House of Commons, and there is a growing view that they will also attempt to boost their representation in the House of Lords to help them pass legislation. I’m aware that (aided by our increasingly polarised media landscape) this might be concerning for some of our clients, especially in relation to what that could mean for you and your investment portfolios. Therefore, I thought it would be helpful to put the likely outcome into some context.

We’ve now seen the manifestos from the main parties and there has been a lot of coverage about what they contain, and what they don’t. On the whole there is not a great deal of difference between what Labour and the Tories are proposing, outside of a few key headlines. This is largely because the parlous state of the UK economy and the huge amounts of government debt racked up during Covid have left little room for meaningful tax cuts or dramatic spending increases. The reality is that once the results are in, we'll begin to see what happens when promises and aspirations hit stark realities.

For the purposes of this update, I’m not going to address the specifics of what the outcome might mean for specific products in terms of the taxes you might pay or the benefits you could lose. For one, this would be guesswork at this stage, but also I want to focus on the potential impact on investment returns from a UK perspective as this is more relevant to these updates.

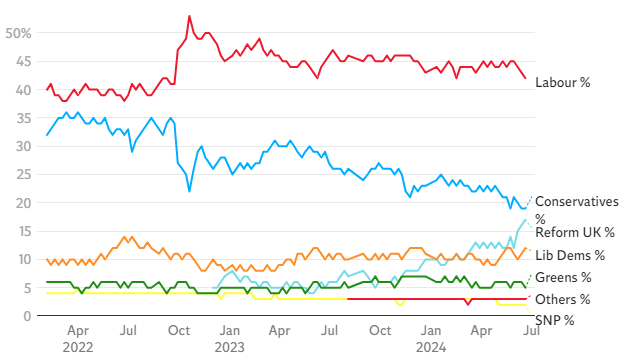

The first thing to highlight on this front is that Labour have had a huge lead in the polls for some time now and markets have long since priced in that outcome. Any fears about what a Starmer-led government might mean for the UK economy will have already been factored into share prices. What might be more important is the size of a Labour victory as markets don’t like uncertainty. If there is a clear majority which allows legislation to be passed without all of the back and forth we’ve seen of late, that should help to keep things calm.

Labour's polling lead over the Conservative Party

Source: www.independent.co.uk, data to 20/06/2024

There is a general perception that the UK economy performs better under a Tory government, but 14 years of Tory rule have eroded their reputation as the party of business, exacerbated by the disastrous Truss budget. Labour recently secured the backing of over 100 business leaders supporting their claim to be a safe pair of hands.

UK politics have been dominated by Labour and the Tories for over 100 years but, somewhat oddly, there aren’t a great deal of studies looking into which has been better for the economy. What research there is indicates that there’s really not a lot between them. In reality, the result of general elections rarely determine how well portfolios perform, certainly over the longer term, because it is global events that really drive returns. This is increasingly the case as the UK's influence on the global stage reduces.

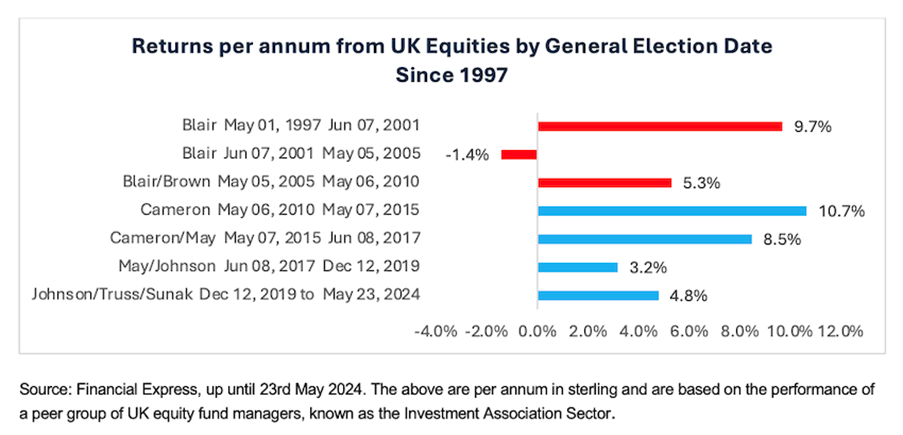

The chart below shows the annualised returns of the UK Equity sector (this is a collection of funds which invest in the UK rather than a stock market) after each general election since 1997. It demonstrates that returns have largely been positive in each period, regardless of the party in power. The two outliers (Blair’s second term and Cameron’s first) were decided not by the ruling party, but by external factors. The former includes the fallout from the bursting of the tech bubble at the turn of the century, while the latter is the bounce back from the global financial crisis.

Returns per year for UK Equities since 1997 by General Election date

Source: Financial Express via Nucleus Financial, IA UK Equities to 23/05/2024

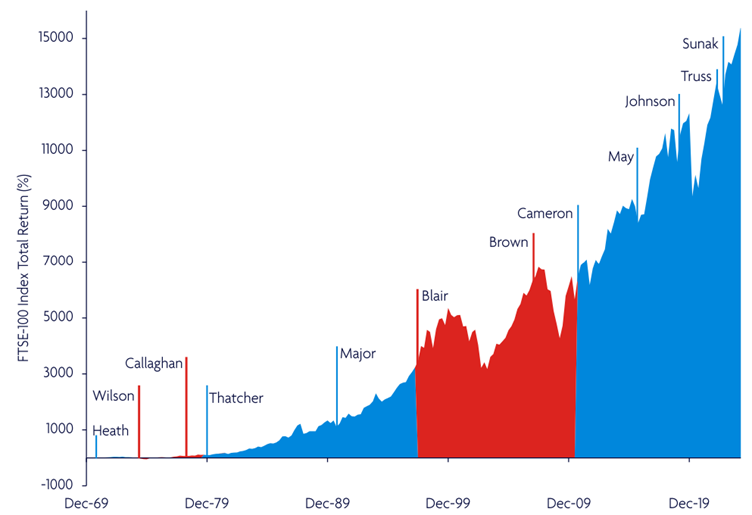

This next chart shows the long term returns of the UK market (based on the FTSE 100 index this time) over the long term, broken down by which party was in power. As it demonstrates, by far the most important factor to consider is that staying in markets, rather than trying to time them, is usually the better tactic.

FTSE 100 returns since the 1970s by prime minister

Source: Bloomberg via Omnis Investments, FTSE 100 to 08/04/2024

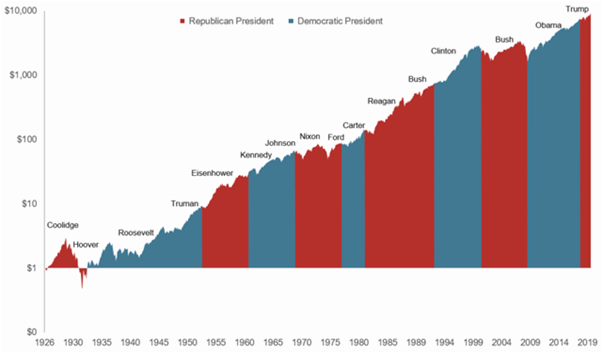

For what it’s worth, we see a very similar picture if we look at the US. It’s fair to say that what happens in America is a lot more important than what happens in the UK from a global investment perspective, but there’s no precedent for a president doing something so damaging that remaining invested over the longer term wasn’t the best strategy.

S&P500 returns since 1926 by US president

Source: professionalfinancial.com, S&P500 index to December 2021

It is normally quite dangerous to try to second guess how markets might react to events. Many forecasters expected markets to fall if Donald Trump managed to secure a surprise victory against Hilary Clinton in the 2016 US presidential election. In the event, markets rose on the first day after the result was known so even if an investor had been confident that Trump would win, despite what the polls were saying, there was no guarantee that they would have made the right investment decision.

Hopefully this update helps to provide some useful context around this coming period. In recent updates I’ve highlighted various factors which have the potential to impact on portfolio returns, including Chinese aggression and supply chain issues. Whilst these outcomes are pretty far down the probability scale, they would be more impactful than Labour taking power and investing for the long term (where your objectives allow) is invariably the best approach to take.

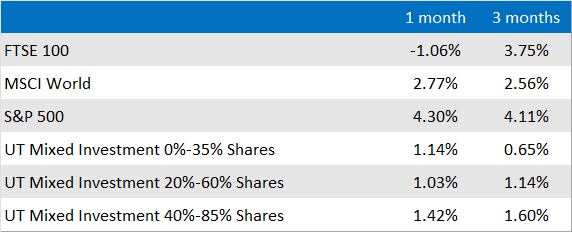

Market and sector summary to the end of June 2024

Source: Financial Express Analytics.

Past performance is not a guide to future performance, nor a reliable indicator of future results or performance.