Firstly, let me wish you a happy and healthy new year on behalf of the IMS team. I hope that you had an enjoyable break.

Recessionary fears cast a long shadow at the start of 2023, fuelled by relentless interest rate hikes. While rates continued to rise through much of the year, a significant shift in sentiment occurred by December, with the focus turning to when the first cuts might come.

The timing of when to reduce interest rates is far from straightforward. If the central banks move too soon they risk undoing the work already done, but if they wait too long they could cool things too much and cause a deeper recession. There are other potential consequences too; for one, government borrowing has become increasingly expensive as interest rates have risen so the pressure is on to bring these costs down. UK Government borrowing was higher than expected in November at £14.3bn while the fiscal deficit in the US hit $1.7tn in September, the third highest amount on record.

The Federal Reserve, European Central Bank (ECB) and Bank of England (BoE) all held rates at their respective current levels at their final meetings of the year. However, there were some meaningful differences in the briefings that accompanied the updates. Christine Lagarde of the ECB said that rate cuts didn’t even form part of their discussions, noting that there was still “work to be done” to tame inflation.

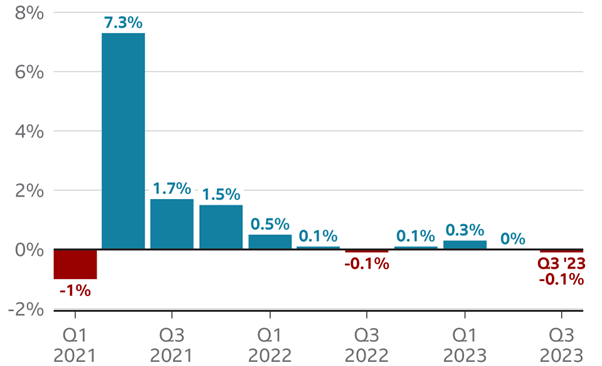

Ahead of the BoE's latest well-predicted decision, the CBI forecast that UK interest rates will remain unchanged until at least 2026. For its part, the BoE reasserted its willingness to tighten further should the inflation picture dictate it. This contrasts with market expectations of cuts in the region of 1% this year, although the mix of opinions on the rate setting committee suggests that there is quite a large chance that markets will be disappointed. They will also have a watchful eye on the impact of the current level on the economy after GDP unexpectedly shrunk by 0.1% in October.

UK economy on recession watch as growth falls in Q3 2023

Source: Office for National Statistics via BBC

The Fed was a lot more sanguine in its update, appearing to move on from the “higher for longer” mantra. In contrast to their colleagues at the BoE, the Fed suggested that it was keen to act swiftly and to start cutting rates “way before” inflation hits the 2% target. This view was heightened by the latest reading which showed that prices rose by just 3.1% in November.

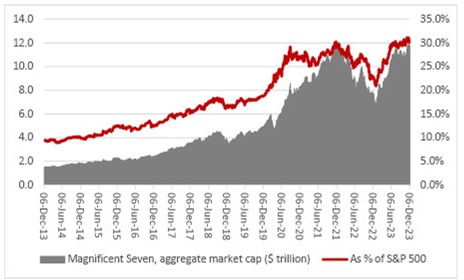

A big focus for investors in 2024 is the outlook for the so-called Magnificent Seven, the moniker given to Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA and Tesla – the biggest stocks in the US which drove most market returns last year. The group now accounts for 30% of the main US market and they tend to thrive when interest rates are low. The Fed has said it can see a path to two rate cuts this year and markets are pricing in as many as five. If this does not come to pass it might spell trouble for the engine of the global economy.

The Magnificent Seven have grown much more rapidly than other stocks in the index

Source: LSEG Datastream via investcentre.co.uk

One factor that will be critical in determining whether this happens is the path that inflation takes. The central banks will be happy that inflation has fallen rapidly from its double-digit peaks, but there are some storm clouds on the horizon. In the UK, shop price inflation has fallen almost 16% since the peak last April, but falls stalled in December for the first time in six months.

In addition, drought has caused low water levels in the Panama Canal which has halved its capacity while two major oil companies have suspended sending shipments via the Red Sea due to militant attacks. The two routes account for almost 20% of seaborne trade. This could see prices start to rise again and acts as a reminder that climate change and geopolitical tensions remain an ongoing challenge in contrast to the one-off impact of the pandemic.

On a more positive note, 2024 has been described as a “year of democracy”, with more than half the world’s population being able to vote in at least one election. In the UK, debate rumbles on about when Rishi Sunak will call an election but with the next budget happening earlier than planned in just two months' time, it suggests it could be sooner than previously expected. Elsewhere, there are elections in India, Taiwan and of course America returns to the polls in November.

This is likely to be a very contentious affair with Donald Trump set to face Joe Biden, with the former embroiled in a raft of court cases and the latter facing questions both about the American economy and also his fitness to face another term. The outcome has the potential to impact a number of critical geopolitical situations including funding for Ukraine’s fight against Russia and the ongoing conflict between Israel and Hamas in the middle east.

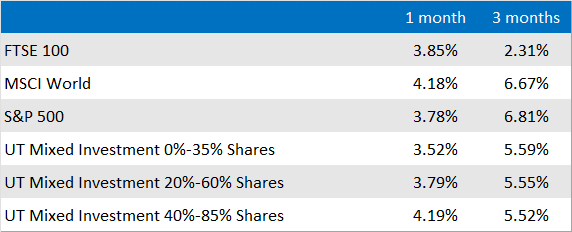

I finished the first update of 2023 with a comment about the softening of rate expectations, saying “should this theme be echoed in other central banks it could well create more clement conditions for world markets in 2023.” As it happened, 2023 saw markets enjoy their strongest year since 2019, largely thanks to a rally in the final two months as investors bet on rate cuts in the new year.

The spike was heightened by the comments from the Fed, as mentioned above, and it was US markets that powered ahead over the final quarter with the UK finishing some way behind. This makes UK stocks even more attractive on a relative basis but the big question for investors such as us is whether this will lead to an improvement in domestic returns or will the Magnificent Seven help US markets move even further ahead.

Market and sector summary to the end of December 2023

Source: Financial Express Analytics.

Past performance is not a guide to future performance, nor a reliable indicator of future results or performance.