Thank you to everyone who has already responded to the latest review of the IMS portfolios which was sent out last month. We’ve had an excellent response so far, but if you have not yet had an opportunity to send us your acceptance, we would be grateful if you could so that we can make sure your investments are in the latest fund selection. You can respond to this message if you would like another copy of the review to be sent out.

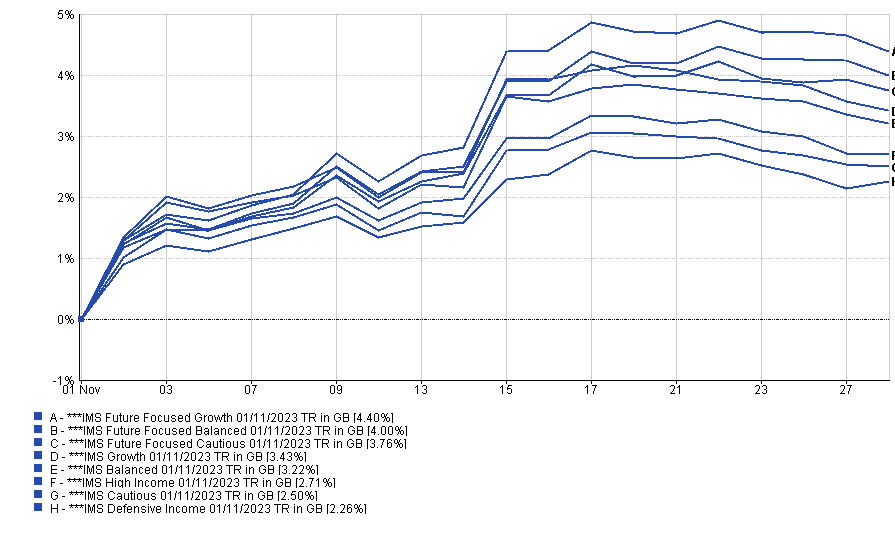

The first thing to highlight is that we have seen a rapid improvement in performance since the performance data was captured for the review. Markets have rallied and all of the portfolios (including the Future Focused models) are now positive over the last one and three months, reversing the performance shown on the main review summary document.

Post-review portfolio performance

Source: Financial Express Analytics, 01/11/2023-28/11/2023

The consensus on why this has happened is that markets are of the view that inflation and therefore interest rates have peaked and they’re now focused on when the cuts will come. This is despite some pretty clear messages from central bankers that it’s not something they’re thinking about themselves. US Federal Reserve (Fed) chief Jerome Powell has spoken about how another rise might yet be needed, while Huw Pill of the Bank of England (BoE) said that we shouldn’t expect to see cuts before the middle of next year.

Their focus is on returning inflation to the target level of 2% whilst trying not to overly cool their respective economies leading to a recession. The UK’s Office for Budget Responsibility said last week that it’ll be the middle of 2025 before we get back to target and a recent Fed report suggested that US inflation won’t get back to the preferred level until 2026. This suggests that price pressures will remain high for some time, even without any additional surprises.

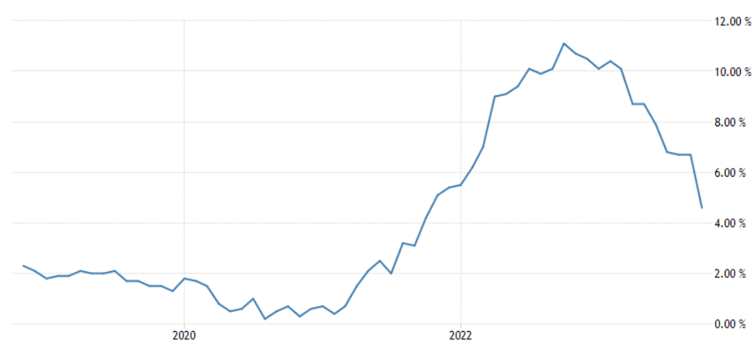

From a UK perspective, there was good news in the form of a sharp drop in inflation in September. The rate fell to 4.6%, more than 2% lower than the previous reading, and slightly more than had been forecast. Despite this, the governor of the BoE, Andrew Bailey, went on record to say that the UK’s growth outlook is the worst he has ever seen. This, he said, would mean that interest rates will remain at 15-year highs with the rate at which inflation is falling to slow markedly this month.

The drop was the fastest on record and was quickly jumped on by the prime minister as halving the rate from 10.7% was one of his five pledges. However, various publications have expressed concern as the self-congratulation has caused confusion in relation to the BoE’s actual target, especially as bringing down inflation has for some time been the priority of the central bank, not government, and there is little the latter can do to influence matters.

UK Inflation

Source: Office for National Statistics via tradingeconomics.com

Whilst it’s a relief to see the rate of price increases slowing, it’s arguably little comfort for consumers who’ve seen their food and fuel bills rapidly rise with a lot of the earlier increases locked in. This is reflected in a fall in retail sales for October which fell 0.3% from the month before to hit the lowest level since February 2021. The Office for National Statistics had already lowered the original reading for September to show a larger fall of 1.1%. Consumer confidence also took a big hit in October with the level dropping to -30 from the previous month, although the latest reading has shown an improvement.

In the US, inflation fell to 3.2% in October, its first fall in four months. This helped contribute to the market recovery noted above with the main US market experiencing its largest daily rise since April in response. The minutes from the latest Fed meeting suggested a softening of its stance on future rate rises. Previously there had been a suggestion that a little more needed to be done to control inflation, but following a fall in October, the view now seems to be moving towards holding firm unless price pressures return. The market has taken this one step further and has interpreted the softening as a sign that rates could fall as soon as next summer. This has seen bond yields fall with the dollar also moving lower.

This is the same position taken by the European Central Bank which, like the Fed, held rates at its latest meeting. Just before the month came to an end it was confirmed that Eurozone inflation fell to its lowest level in over two years in November, moving from 2.9% to 2.4% as energy prices moved lower. There is rising hope that we can avoid a lot of the volatility which we experienced in gas prices last winter with European storage levels at 96% of capacity. This should help to mitigate the threat from Russia, but pressure could instead come from oil prices.

OPEC+, the organisation representing the leading group of oil producing countries, is seeking to extend oil production cuts, in part as a reaction to events in the middle east. However, it surprised markets at the end of the month by announcing that it was postponing its planned meeting. This is unusual not just because oil prices are well down from recent highs, but also because it will overlap with the next round of the COP climate talks which are being hosted by an OPEC member. It suggests that an agreement for further cuts is proving hard to reach and the news saw prices briefly fall below $74 a barrel.

Oil Price Pressure

Source: Morningstar via BBC

The last month of the year is generally quiet, although it would be unwise to assume that this will be the case. As highlighted at the review, we have taken steps to add a degree of downside protection to many of the models which hopefully will not be needed, but, as shown at the start of this update, things can change very quickly. If nothing else, this reminds us that we should try to avoid focusing on short term fluctuations.

This is the final update of the year so from all of us in the IMS team, have a wonderful Christmas and here's to a prosperous new year.

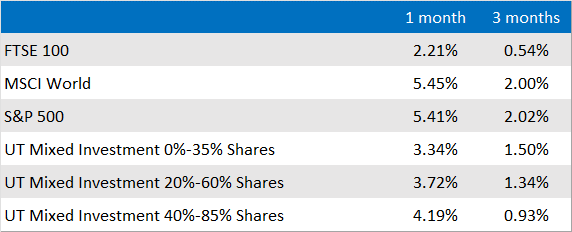

Market and sector summary to the end of November 2023

Source: Financial Express Analytics.

Past performance is not a guide to future performance, nor a reliable indicator of future results or performance.