The factors driving markets over the last month have had a familiar ring to them. 2023 has been dominated by the actions of central banks and September was no different. However, the end of the month saw some decisions made which might suggest that we’re moving into a new phase.

With the European Central Bank having already voted to increase its main interest rate to a record high of 4% in the middle of the month, the focus turned to what the US Federal Reserve (Fed) and the Bank of England (BoE) would do. In the lead up to their decisions the market had grown increasingly confident that the Fed would leave rates unchanged for the second time this year, but the BoE were expected to implement a further rise.

The background to both decisions was decidedly mixed. In the US, jobless claims fell by a higher amount than expected at the end of August, hitting the lowest point since February. Conversely, the overall inflation rate rose over the same month, up 0.5% from July’s 3.2%, with part of the rise a result of higher fuel costs following a surge in the oil price. In the UK, inflation was moving the other way with the rate falling to 6.7% in August from the 6.8% seen in July.

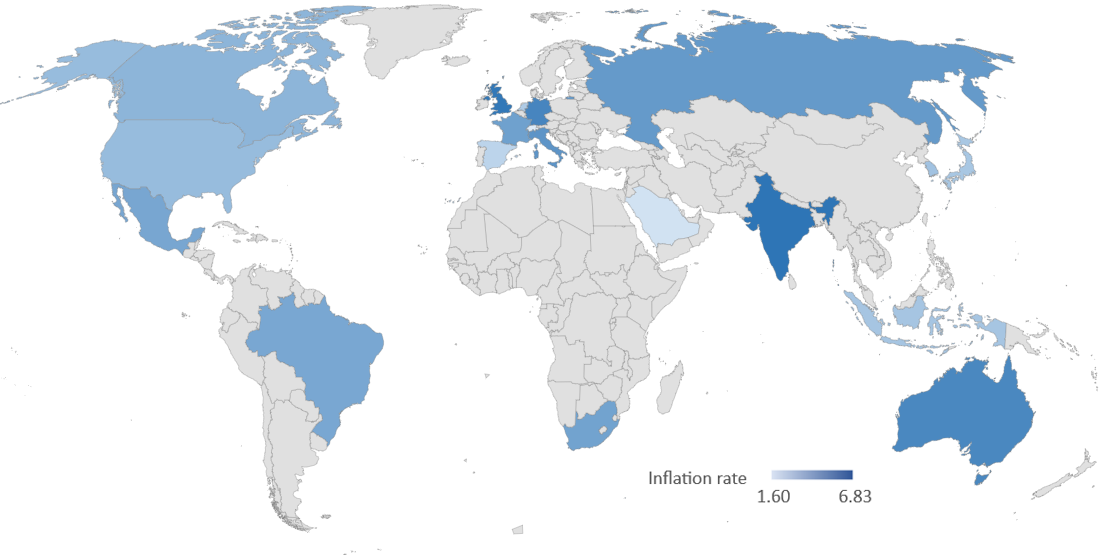

This was better than the jump to 7% that the Office for National Statistics had forecast, a prediction that was largely shared by other forecasters (and Jeremy Hunt) given the rise in fuel costs, but these were countered by falls elsewhere. At 6.2%, core inflation (the rate that excludes food and fuel) was 0.7% lower than expected as well. However, the UK rate remains unfavourable compared to the US and the EU which stand at 3.7% and 5.2% respectively.

G20 Inflation Rates (excluding China, Turkey & Argentina)

Source: Trading Economics

In the event, the Fed’s meeting went as predicted with no change made to the headline rate while the surprise fall in inflation the day before seemed to be enough of a prompt for the BoE to keep the base rate unchanged for the first time in almost two years.

Unfortunately, the fact that rates stayed the same, something that would usually be music to the market’s ears, was less important than the accompanying rhetoric. While announcing their decision to keep the US interest rate in the 5.25-5.5% range, the Fed rate setting committee stressed their commitment to keeping the rate high, suggesting that as few as two cuts might be seen next year. This is half as many as the market was expecting prior to the announcement.

They’re also keeping their powder dry and leaving the door open a further hike later this year if necessitated by conditions. In response, Treasury (US government) bond yields pushed towards a 16-year high while US markets fell by the largest amount in 6 months, reversing a rise that occurred in anticipation of the decision. The falls were led by many of the mega cap tech companies which have provided the bulk of returns this year.

The decision by the BoE was far from unanimous. The tally stood at four-all before chair Andrew Bailey’s deciding vote, the first time he's needed to use it since February 2022. All four members pushing for a rise wanted an increase of 0.25% which would have taken the headline rate to 5.5%. Although the decision helped UK markets weather the US-focused storm better than other indices thanks to the resulting drop in sterling (which benefitted many large British firms that make money in dollars), it feels a little premature to celebrate “the end of rate rises” as touted by some in the media. There remain a lot of potential headwinds that could yet see rates move higher.

On the subject of interest rates, Argentis have written a blog post which looks at some of the factors to think about when considering taking advantage of the higher saving rates currently on offer. This can be found here and I’d encourage you to read it if this is something you’re contemplating.

Although oil prices retreated slightly in response to the news from the US, fears are rising that Russia is engaging in the same tactics it employed last winter. Having worked with OPEC to reduce production levels, the factor that caused oil prices to rise in the first place, they have now announced a curb on exports of diesel and petrol. The move comes just as the major central banks appear to have turned the tide on inflation and could cause price rises to move higher again. One positive is that European gas stockpiles appear to be in a much better place this year.

Oil prices

Source: Factset, three months to 27/09/2023

Of course, one of the main aims of raising interest rates is to temper demand from consumers, thereby increasing supply and bringing inflation back down. While this works for the purchase of TVs and cars, it's less effective for things over which we have less control, such as commuting to work or heating our homes. This again brings into question the benefit of trying to control price rises in such an untargeted way. Indeed, the apparent change of heart following a single piece of inflation data doesn’t help with the impression that the BoE are making it up as they go.

Hot on the heels of the surprise update to UK historical GDP data that I highlighted last month, the latest release confirmed that the economy fell back by 0.5% in July. This was entirely predictable with rainfall during the month at 170% of the average always likely to reverse June’s strong performance which coincided with a very warm period. Strike action contributed to a fall in all three main sectors with corporate weakness also apparent.

This echoes the challenge faced by other large European economies such as Germany which has announced a package of support for its construction industry which has struggled in the face of rising interest rates. The US is the outlier as hopes for a "soft landing" persist, although the 2.1% rise for the second quarter was slightly lower than had been forecast.

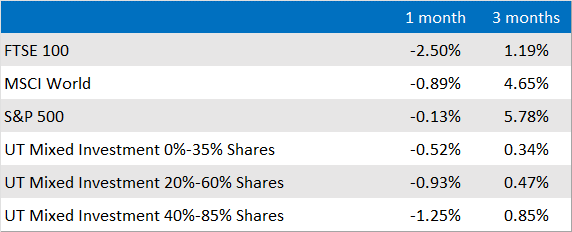

Things got quieter as the month came to a close as markets considered their next move. As shown in the table below, the UK was a strong performer in contrast to the US, a positive sign for our portfolios which have occasionally been held back by the strength of a small subset of high-growth American stocks. We have a little while to wait until the major central banks meet again by which point we should have a better idea whether the current pause can translate into something more permanent.

Market and sector summary to the end of October 2023

Source: Financial Express Analytics.

Past performance is not a guide to future performance, nor a reliable indicator of future results or performance.