Thank you to everyone who has already responded to the latest review of the IMS portfolios which was sent out last month. We’ve had an excellent response so far, but if you have not yet had an opportunity to send us your acceptance, we would be grateful if you could so that we can make sure your investments are in the latest fund selection. You can respond to this message if you would like another copy of the review to be sent to you.

The review went out in early August, a month which is a famously quiet month in typical years. With politicians, central bankers, investment managers and their clients all off on holiday for much of the period, there is usually a lull in news and activity with markets bubbling along slowly. That wasn’t quite the case this year.

Instead, investors were focused on the health of the world’s two largest economies, albeit for very different reasons. On one hand, China’s initial post-pandemic boom has faltered with a run of weak data (including the sharpest fall in exports since Covid) and a return to concerns about the property sector. A much-anticipated intervention by the government in the middle of the month proved to be disappointing and will do little to correct the country’s current deflationary trend.

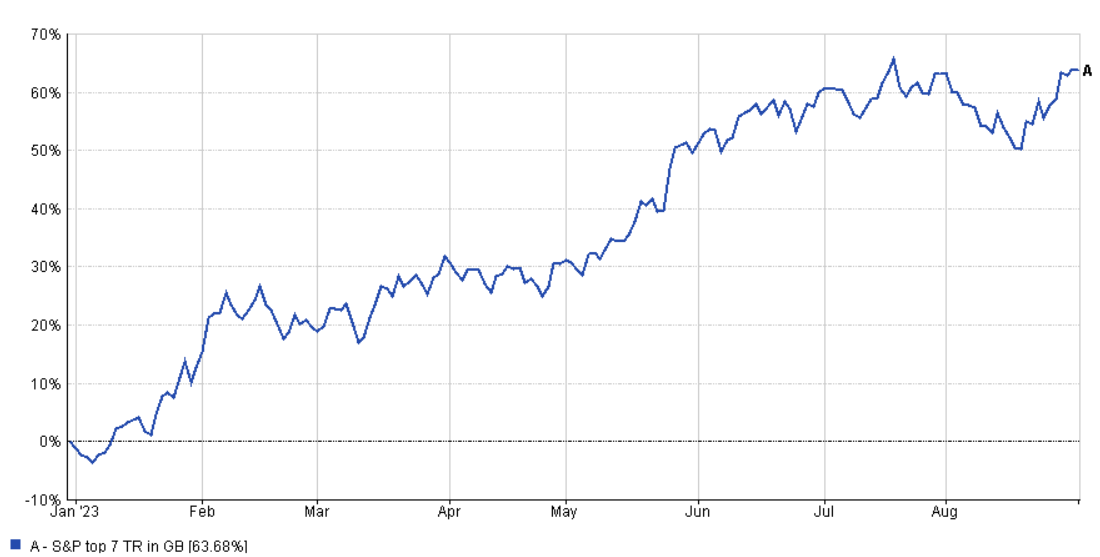

Meanwhile, indications at the start of the month were that the US economy appeared to be in stubbornly fine fettle which is leading to fears that the Federal Reserve (Fed) will be forced to continue its rate rising mission. In reaction, yields on US government debt recently spiked to 2007 levels while at one stage the share prices of the big 7 tech firms had lost almost a trillion dollars. For context, however, this happened after the longest positive streak for the main US index since 2021, and the fall in the biggest stocks was quickly reversed.

A brief but cooling dip

Source: Financial Express Analytics. Data to 01/01/2023-01/09/2023 in pounds sterling

The latest employment report also showed that fewer people had applied for unemployment support, retail sales grew by more than predicted in July while headline inflation rose slightly to 3.2% over the same period. All eyes were understandably, therefore, on the Fed’s chair when he took to the stage at a major central bankers’ summit at Jackson Hole at the end of the month. In advance of the meetings, Jay Powell had stuck to his mantra about rates being “higher for longer” as he tried to control the narrative and avoid investors second guessing his level of commitment but in the event, his speech was largely unoriginal. The main theme was that he believed that inflation was still too high and that more rate rises might be needed to bring it under control.

The minutes from the latest Fed meeting suggested that the committee members were split over what action they should take. While the eventual vote was unanimous, some of the members had indicated a preference for keeping rates on hold to allow more time to assess the impact of their earlier efforts.

We’ve also had quite a lot of data on the UK economy of late and while lots of it has been positive, it hasn’t been enough to improve the fortunes of UK PLC. GDP for the second quarter was 0.2% which is to be welcomed, but the boost from a warm final month is likely to be reversed following July’s washout. One big positive for the government was the revision to some older GDP data. The Office for National Statistics revealed at the end of the month that by the end of 2021, the UK economy was actually 0.6% larger than the pre-pandemic level, as opposed to being 1.2% lower as had been previously reported. Whilst this won’t be of much comfort to Brits who are struggling to pay their bills, it does mean our recovery was in line with our peers.

Wage growth was reported as 7.8%, but this includes the recent NHS pay deal which clouds the figure and shouldn’t cause the Bank of England (BoE) to think that wages are still acting as an inflationary driver. The picture on inflation was equally obscured with the drop in July’s headline rate to 6.8% a reflection of the fall in the energy price cap. This means we’re still 1.5% ahead of the G20 average with core inflation remaining sticky and service inflation rising. Thankfully there’s time for one more reading before the Bank next needs to make a decision.

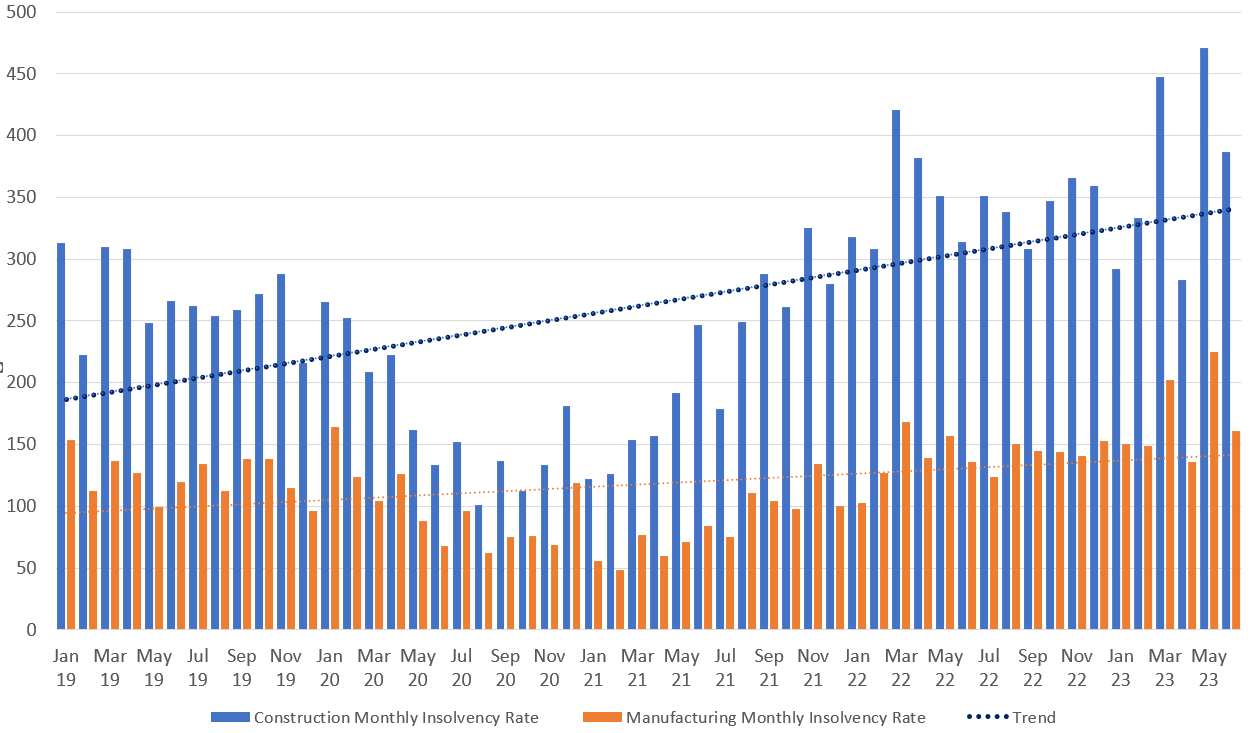

Aside from the spectre of a general election next year (and the inevitable political pressure that leads to), the urge to avoid unnecessary interest rate rises is rising because of a growing fear that previous hikes are already having a deleterious effect on UK companies. The BoE recently warned that British firms are finding it increasingly hard to service their debts. The bank predicted that the number of companies with a low ratio of earnings versus interest expenses will rise to 50% by the end of the year. These additional costs have come at the same time as inflation has risen, while the support structures introduced during covid have been removed, factors which are being blamed for the highest rate of insolvency for construction companies in a decade.

A tough market for the construction sector

Source: The Insolvency Service

For the members of the rate setting committees at both the Fed and BoE, as well as their partners in the European Central Bank, one additional factor that might be forefront in their minds ahead of their next vote is the latest Purchase Managers’ Index data which measure how well different sectors are doing on a month by month basis. This indicated that the services sector held up relatively well with most major countries reporting a value above 50 for July, indicating growth, although not as much as had been expected in many cases. However, as suggested by the chart above, the results of the manufacturing sector were more concerning. Both the US and UK came in below 50 suggesting the sector is contracting, with the UK number sitting at a 39-month low, something which might add to the feeling that sufficient cooling is already taking place.

As is so often the case, a lot is riding on the decisions of the men and women who sit on the rate setting boards of the world’s major central banks. Theodore Roosevelt once said that in any moment of decision, the worst thing you can do is nothing, but perhaps in this instance the best thing they could do is to have the courage to wait and see if their previous actions have already begun to take effect.

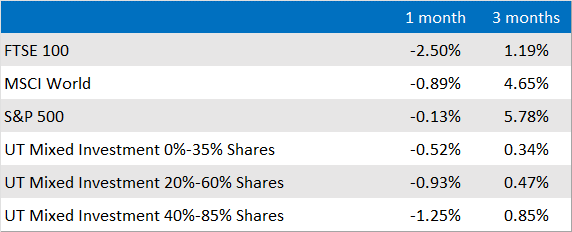

Market and sector summary to the end of September 2023

Source: Financial Express Analytics.

Past performance is not a guide to future performance, nor a reliable indicator of future results or performance.