Interest rates and inflation remained the primary focus for markets over the month, although there is an increasing disparity in approaches on either side of the Atlantic.

As had been widely predicted, no change was made at the latest meeting of the Federal Reserve (Fed) in the US, with interest rates remaining in a range of 5%-5.25%. The first pause after 10 consecutive hikes was expected, especially with inflation in May falling to 4% (the lowest level in two years), but the accompanying message was that the era of rises was not over.

With inflation running at double the official target, Chair Jay Powell said the pause was designed to give him and his colleagues time to assess conditions. The implication was that there could be two further quarter point increases before the year is out with rate cuts potentially as much as two years away.

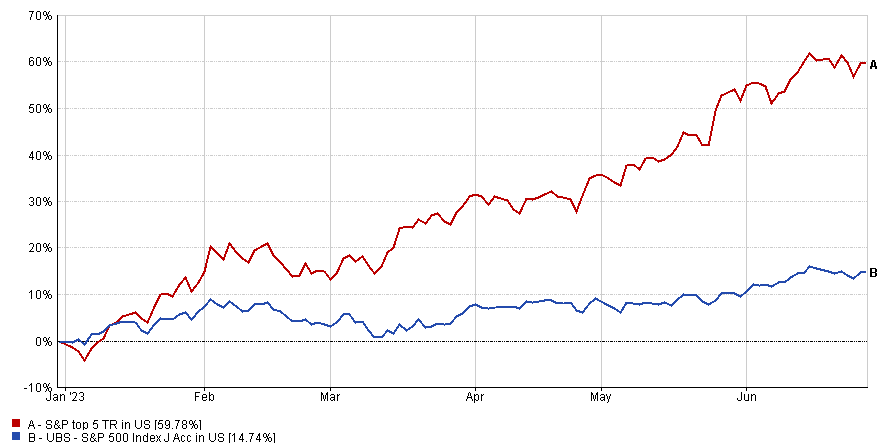

The main US markets had been moving upwards ahead of the vote and, despite a wobble on the day itself in response to the Fed’s comments, saw the largest weekly gains since March highlighting the importance of rate moves on the economy. Despite a bit of weakness towards the end of the month, the US officially entered a bull market (a 20% rally from a recent low), but attention is increasingly being focused on the pattern of this growth. The largest companies in the US are showing exceptionally strong returns this year which is having an outsized effect on the total return of the market:

Performance Concentration

Source: Financial Express Analytics. Data to 29/06/2023, in US Dollars

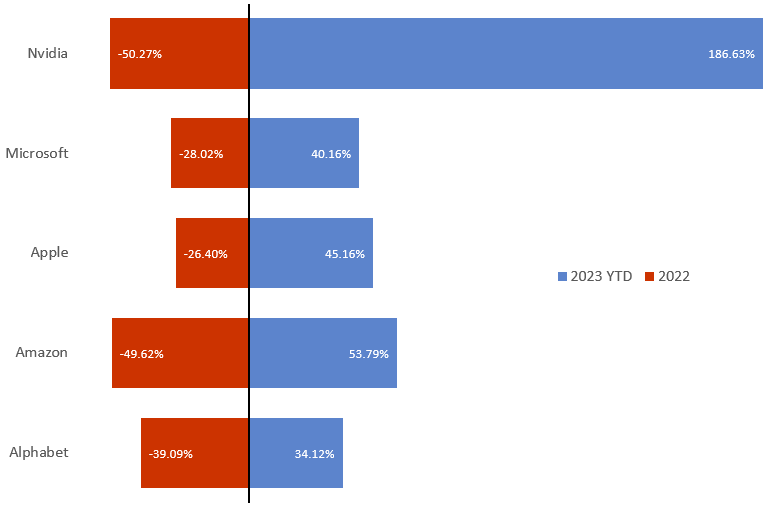

The top five stocks (Apple, Microsoft, Alphabet, Amazon and Nvidia) account for almost 20% of the total value of the main US index which is the highest level for many decades. Whilst they all have varying core functions, they can all be broadly described as technology stocks and having had a torrid time in 2022, this year has seen them rally strongly as investors sought to capitalise on the Artificial Intelligence bandwagon:

What a difference a year makes

Source: Financial Express Analytics. Data to 29/06/2023, in US Dollars

Typically, rising interest rates would act as a headwind because of how it restricts growth, but that has not been the case this year which has led to this increased concentration in the big names. This has implications for our investment approach as it increases the potential for volatility – the reliance on a small subset of stocks that can rise or fall by 30% in a short period means we need to be especially vigilant.

In the UK, the outlook for interest rates is a lot more certain because the Bank of England (BoE) have little choice about what action to take with inflation proving to be much more persistent than hoped. The figure for May was 8.7%, exactly the same as it was the month before and the fourth month in a row that it came in above forecasts. More worryingly, core inflation (the rate excluding things like energy and food) actually rose to hit the highest level since 1992. Another headache for the BoE is data showing that unemployment has continued to fall alongside an increase to wage growth which suggests that previous attempts at tightening have not had the desired effect.

At its latest meeting, the BoE surprised forecasters by hiking interest rates by a full half percent compared to the 0.25% rise that had been expected. Given recent testimony given to MPs by BoE chief Andrew Bailey about the poor quality of the Bank’s modelling, some have begun to question the effectiveness of current monetary policy. Interestingly, while seven out nine voting members plumped for the 0.5% increase, the remaining two opted to keep rates unchanged. It is possible that the outliers have lost faith in the research and analysis they usually rely on and are unwilling to simply keep pushing through rises until economic data worsens.

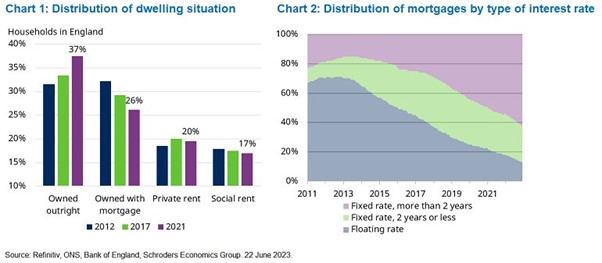

Expectations for further interest rate hikes continued to push mortgage rates higher. The current rate is said to be close to the equivalent level seen in the era of double-digit interest rates of the 80’s. This is because people now borrow much more relative to their income making mortgage payments just as difficult despite rates being a third of the level seen 40 years ago. Despite this, one theory for why interest rates are failing to rein in inflation is that the number of people with mortgages has fallen, whilst many of those who do have one took advantage of low interest rates to lock into longer term deals:

The changing profile of the UK mortgage market

Source: As above

Although recent data showed that the UK saw GDP grow by 0.2% in April (up from the 0.3% fall in March) it will mean little to people facing higher mortgage costs (and by extension rental payments). Whilst this sees the UK avoid a recession for now, both the BoE and the government have become increasingly vocal about the idea that entering a period of negative growth might not be such a bad idea. Gilt yields (the amount of interest the government pays on its debt) have returned to the level they hit following the disastrous Truss/Kwarteng mini budget as recession expectations have risen.

One impact of rising gilt yields is that UK debt has risen above GDP for the first time since 1961. This follows data which showed that borrowing for May was nearly twice that for the same month last year and the second highest May number since records began. Whilst the higher gilt rates don’t apply to existing debt, it does make any new borrowing more expensive which limits the government’s ability to cut taxes or fund new initiatives. Whilst this isn’t ideal for their political prospects, it might help the BoE to achieve its goals.

Views on rate rises in Europe are on an equally clear trajectory. The European Central Bank (ECB) president, Christine Lagarde, said recently that there is no clear evidence that inflation has peaked despite May’s data falling to 6.1% from 7%, ahead of expectations. Food price inflation was also lower, falling to a rate not seen since September 2022. The ECB raised interest rates in June to the highest level for 22 years with the hike to 3.5% almost certain to be followed by another in July. The latest GDP reading of -0.1% saw the EU fall (just) into a technical recession after the figure for the final quarter of 2022 was revised down to the same rate.

With a month to go until the next IMS review, we will continue to monitor developments on all of the above while keeping any eye out for any other elements that might not make the main headlines. Our focus on building diversified portfolios has served us well and will remain our focus as we move through these interesting times.

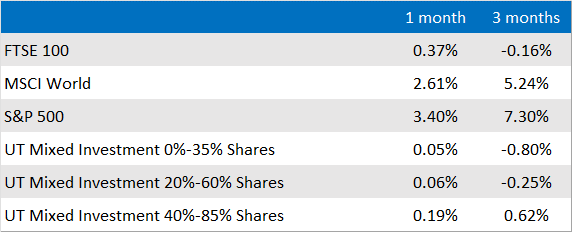

Market and sector summary to the end of June 2023

Source: Financial Express Analytics.

Past performance is not a guide to future performance, nor a reliable indicator of future results or performance.