Thank you to everyone who has already responded to the latest review of the IMS portfolios which was sent out last month. We’ve had an excellent response so far, but if you have not yet had an opportunity to send us your acceptance, we would be grateful if you could so that we can make sure your investments are in the latest fund selection. You can respond to this message if you would like another copy of the review to be sent to you.

I mentioned in the commentary which accompanied the review that without any further shocks, the fight against inflation would remain the preeminent factor. When I wrote that, I was aware that there was a particular issue that could act as a distraction from the relative mundanity of debates over monetary policy: the rapidly approaching US debt ceiling. Concerns about this recurring headache have been floating around for a while but as we headed towards an uncertain deadline date, they began to peak.

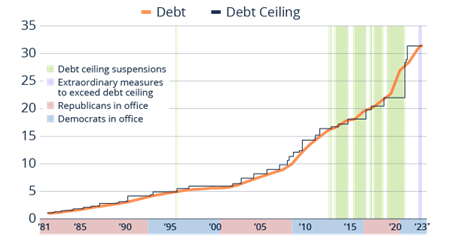

By way of background, the debt ceiling was created during World War I as a way of making the issuance of debt more straightforward (at least in theory). Prior to its creation, each issuance had to be approved by Congress which proved to be too unwieldy at times of crisis, but it remains a controversial issue and many people believe it should be reformed or even eliminated entirely. It has been raised 78 times since 1917 without the US government ever falling into default because all but the most radical of politicians know that doing so would be catastrophic.

Debt ceiling and gross federal debt from 1981 to 2023

Source: Office of Management and Budget, US Treasury Dept. *Data to 08/05/2023 in trillion US dollars

The actual deadline is hard to predict because it depends on a number of factors including how much the US Treasury collects in taxes and how much it has to spend on welfare. Janet Yellen, the Treasury Secretary, has for some time been saying that the well would run dry at the start of June but many Republicans prefer to believe the private forecasters which have estimated that this won't happen until around a week later.

There is often a lot of brinkmanship leading up to the deadline when one party is not in control of both parts of Congress as is the case at the moment. The situation is complicated by the particularly fractious political climate, but leading up the the end of the month, both sides were keen to highlight that they were working together to find a resolution. Well, most of them anyway. Former president Donald Trump, the front runner in the race to be the next Republican leader, had called for his party to force a default if the Democrats refused to agree to deep spending cuts. This is a line that has been used by fringe members of his party for a while now, but, on the whole, their priority is to be seen as fiscally sensible.

Going into the negotiations they had a wish list of spending cuts they wanted to secure and they would have been keen to capitalise on Joe Biden looking relatively weak. History tells us that the political risks are high and whilst there is often an assumption that they’re higher for the incumbent, the last few occurrences haven’t worked out well for Republicans. They’ve only got a small majority and despite recent falls in inflation, they will be wary of creating a situation that makes US voters poorer.

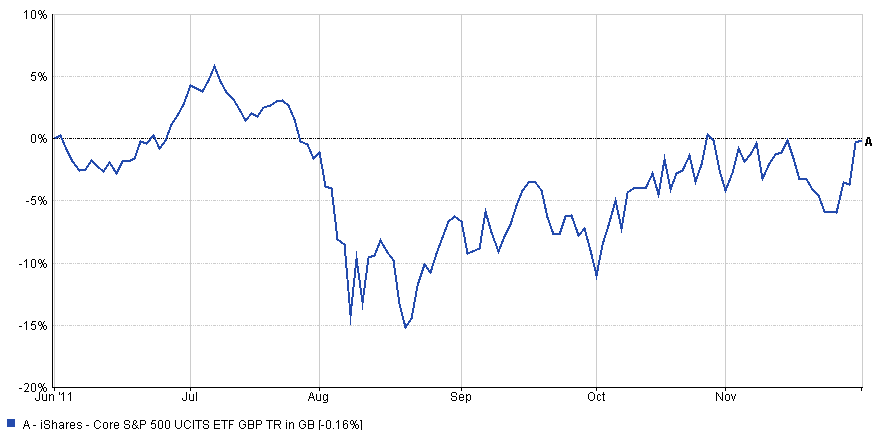

One of the risks of failing to secure an extension prior to the deadline is that it is possible that bluffs are called to the point where parts of the US government need to be shut down to reduce spending. If this happens, it naturally spooks markets and causes bond rates to rise but, as we saw in 2011, the impact was very short in relation to typical investment horizons:

Market reaction to delays in agreeing a new debt ceiling in 2011

Source: Financial Express Analytics 01/08/2011-01/12/2011

As the US has never failed to agree an increase to the debt ceiling we don’t know for certain what the impact would be. Goldman Sachs have estimated that it would immediately chop 10% off their GDP while other analysis suggested that it would cause the loss of three million jobs, create a housing crisis and, ironically, increase US government debt by up to $1tn. Yellen was quite clear when she talked about it earlier in the year: “Failure to meet the government’s obligations would cause irreparable harm to the U.S. economy, the livelihoods of all Americans and global financial stability.”

Despite efforts to find a compromise, the lack of action had already started to have an impact towards the end of the month. The ratings agency Fitch placed the US at risk of downgrade and while it still expects a resolution to the debt ceiling to be reached, it noted risks have risen, not only due to partisan politics but also a failure to "meaningfully tackle medium-term fiscal challenges". It is also already costing the US government more to borrow money with an auction of short term debt at the start of May going for the highest ever yield.

With the deadline fast approaching, both sides carried out further talks over the final weekend of the month and were able to reach an agreement that lifted the ceiling until 2025. The deal sees military spending untouched but puts caps in place on other spending, however, the Biden administration refused to budge on some of its flagship policies such as clean energy tax credits.

With the deal needing to be signed off by Congress, both parties have the tricky task of convincing their members that it is a fair compromise. Republican House Speaker Kevin McCarthy believes that the majority of his colleagues are "very excited" about the deal, but many of them have expressed frustration and anger about perceived weakness. For their part, the Democrats are not united in support of the deal either with many feeling that too many concessions had to be made. These discussions were continuing as this update was being prepared and it is likely that the crisis will have been averted by the time you read this.

Following on from previous updates where we have spoken about the risks of trying to anticipate market shocks, it is hopefully no surprise that we did not take specific action in response to this situation. As shown by the chart above, even when the US government is briefly forced to shut public parks and furlough its employees, the impact is short-lived and the recovery very rapid. Preparing for a full default is even more complicated. At the point at which one is declared, markets would have already fallen heavily therefore any reaction at that point would be too late. Even if we were willing to forgo our investment principles and the portfolio mandates, and assuming we could find a way to protect investments in advance (would even cash be safe?), taking such extreme steps leaves our clients exposed if the worst outcome doesn't come to pass.

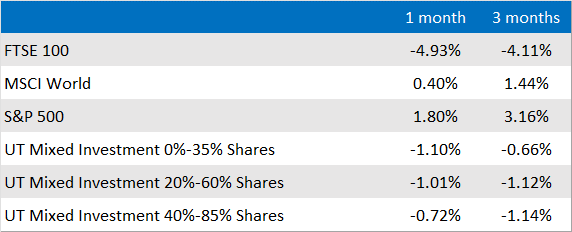

With all that being said, let’s return to more ordinary, albeit very relevant, matters. The latest inflation reading for the UK was recently released and it confirmed that the headline rate had fallen from 10.1% to 8.7% but the drop was not as much as the Bank of England (BoE) had forecast and it was less than the consensus which thought that it might move below 8%. Looking below the top rate, the picture becomes even more murky. Food inflation rose by 19% in the year to April, the fastest rate since 1977 and the third highest level since 2008. This is the highest level in western Europe with the ongoing impacts of post-Brexit trade barriers being blamed for the UK’s particularly precarious position.

Andrew Bailey, the governor of the BoE, has admitted that the bank’s inflation forecasting has been lacking and said that there are “some very big lessons” to be learned. The latest data has reignited the debate over the future path of interest rate rises and the yields on Gilts (UK government debt) have risen as a result. With markets now pricing in as many as four more interest rate rises this year, the yield on 10-year Gilts has returned to the level it hit following the disastrous Truss/Kwarteng budget last year.

UK interest rates now expected to exceed 5%

Source: Guardian/Bank of England

One positive for Bailey and his colleagues at the BoE was the news that the International Monetary Fund (IMF) has backed the bank's view that the UK will avoid a recession this year. The latest forecast of 0.4% growth is a sharp correction from the 0.3% fall that was predicted as recently as April but the IMF was at pains to warn against using the brighter outlook as an excuse to cut taxes. Chancellor Jeremy Hunt will no doubt use this to quieten down some of those in his party who are keen to do so.

In the US, outside of the impasse on the debt ceiling, things are looking more positive. With inflation falling to 4.9% in April, the chances of more interest rate rises have fallen further. The latest fall is the tenth in a row and it led markets to forecast a 100% chance that rates will actually be cut before the year is out. This might be a tad optimistic, but even a lack of additional rises would still be a relief to markets, especially if the debt ceiling passes without a fuss.

Market and sector summary to the end of May 2023

Source: Financial Express Analytics.

Past performance is not a guide to future performance, nor a reliable indicator of future results or performance.