Thank you to everyone who has already responded to the latest review of the IMS portfolios which was sent out last month. We’ve had an excellent response so far, but if you have not yet had an opportunity to send us your acceptance, we would be grateful if you could so that we can make sure your investments are in the latest fund selection. You can respond to this message if you would like another copy of the review to be sent to you.

For many of us, February brought a few spring-like days that hinted that we might be approaching the end of what seemed, to me at least, to be an interminable winter. However, towards the end of the month frosty conditions returned as temperatures dropped, echoing what was happening in markets.

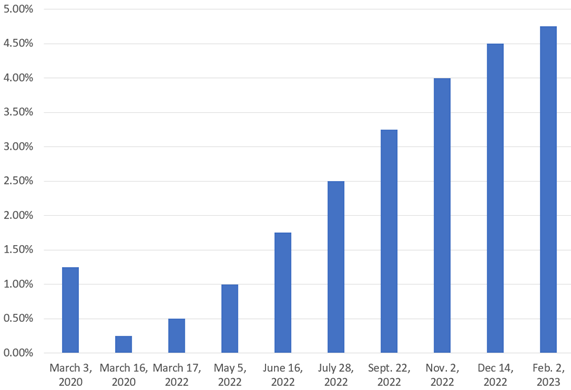

As highlighted in the update that accompanied the review, all eyes, from an investment perspective, were on the major central banks, specifically the US Federal Reserve (Fed). With inflation rising at a level not seen since Regan and Thatcher were in power, the Fed rapidly increased interest rates over the last 12 months from essentially zero to a range of 4.5% to 4.75% to try to tame price rises. In the first month of this year, optimism was high that it was close to achieving its goal after six consecutive months of inflation falls and at its last rate setting meeting at the start of February, it voted for a rise of just 0.25%, its smallest in almost a year:

US Interest Rates

Source: US Federal Reserve

Unfortunately, not long after this rise was announced, the market mood shifted and the main US index failed to register a positive weekly return in any of the full weeks across the month as investors began to reappraise the outlook for future Fed action. Actually, it would be more accurate to describe it as investors coming to the realisation that the Fed wasn't kidding when it said it would keep rates high until price stability had been achieved and that they could not simply will an end to the current rate rising cycle into being with positive thoughts alone.

This is bad for two reasons. The first is that it means there are more rises to come than have been priced in and the second is that it means it will take longer for rates to begin to be reduced. In fairness, the Fed (and their peers) have been trying to get the message out that its work is not done yet with indicators still pointing in the wrong direction.

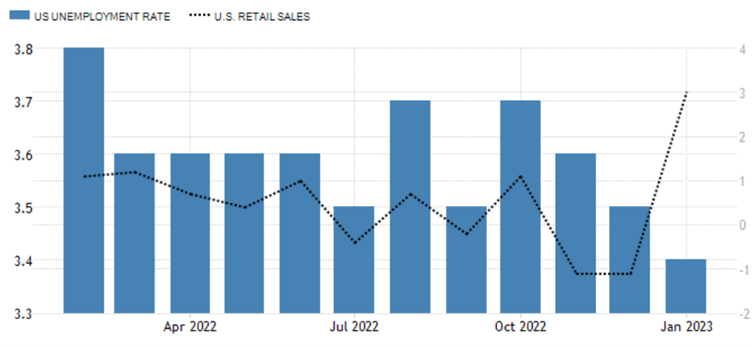

As is often the case, market performance at times like this can often be counterintuitive; good news becomes bad and vice versa and there is no shortage of good news to be found of late. Unemployment remains at a 50-year low with two jobs available for every job seeker while retail sales have unexpectedly started to pick up and manufacturing data has also improved:

Good news abounds

Source: tradingeconomics.com

In addition, while the US inflation rate has fallen by a third from its recent high, the devil is in the detail. Falls in the headline rate have rapidly slowed this year and one key measure, that strips out food and energy costs, rose over January rather than falling as had been expected. This so-called personal consumption expenditures index, which is the Fed’s preferred inflation measure, rose by 0.6% over the month which led to a doubling in the forecast likelihood for a half percent interest rate rise this month.

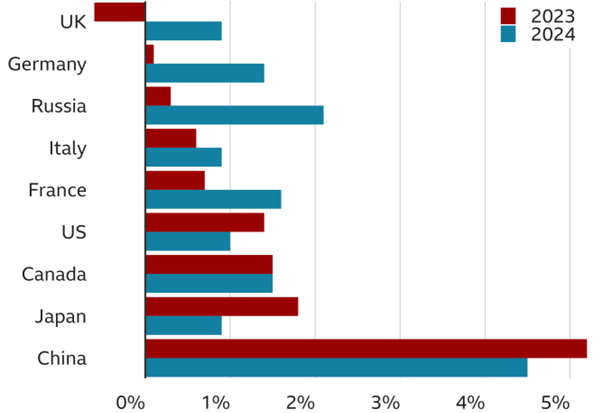

Looking away from the US, we recently received a boost with the Office for National Statistics reporting that UK GDP was not negative in the final quarter of 2022, meaning that we narrowly avoided falling into recession. It’s important to highlight, however, that this is only the first reading and our flat line doesn’t leave much room for error should a future update be negative. Also, while it is most definitely a positive surprise, it doesn’t compare favourably to the 1% recorded by the US and 1.9% for the EU so we should be cautious about putting too much weight on the result, especially given the forecasts for the next couple of years:

IMF 2023/2024 GDP Growth Forecasts

Source: IMF

On the subject of the UK there was something else to cheer about with our main blue chip index closing above 8,000 for the first time on record. The “boring” constituents of the index continued to power the rise with profits in the banking, energy and commodity sectors improving and a weakened sterling helping to boost the returns on earnings generated overseas.

Of course, with recent reports about the relative strength of the UK economy, this record-setting performance from (some of) the largest firms in the country arguably doesn’t tell the full story. Either way, the relative performance of the UK versus the US illustrates the paradoxical nature of market returns and highlights the importance of taking a pragmatic approach to asset allocation.

Market and sector summary to the end of February 2023

Source: Financial Express Analytics.

Past performance is not a guide to future performance, nor a reliable indicator of future results or performance.