Firstly, let me wish you a happy and healthy new year on behalf of the IMS team and I hope that you had an enjoyable break.

I started writing this update by reminding myself of our first message from the beginning of last year. In contrast, it is probably fair to say that we enter 2023 with a little more positivity with the pandemic becoming a background noise (for most of us) rather than the dominant story that it was 12 months ago. Actually, this isn’t quite the case everywhere in the world as we’ll cover later on, but the more pressing concern from an investment perspective is the threat of recession, something which markets don’t like but are much more familiar with.

December had looked like it was going to be a fairly quiet month; the volatility seen earlier in the year (as rapidly rising interest rates created a push/pull effect with slowing inflation) had moderated, but towards the middle of the month two events conspired to cause it to pick up again, threatening the so-called “Santa Rally” – the market rally that is said to occur in the week leading up to Christmas Day.

The Bank of England (BoE), Federal Reserve (Fed) in the US and the European Central Bank (ECB) all met last month and agreed to raise rates by the same amount, 0.5%. So far, so predictable. The first challenge to the seasonal cheer were the comments from the ECB’s president that accompanied the rise. Opting for a smaller rise than last time might have suggested that the ECB were reaching the end of this raising cycle, as seems to be the case in America, but Christine Lagarde was quick to put that idea to bed saying, “if you compare us to the Fed, we have more ground to cover, we have longer to go.”

It wasn’t that long ago that the ECB were confident that inflation would be less of a problem for them than elsewhere, but that notion is now long forgotten. Despite remaining above 10%, there are still signs that inflation is close to the peak, however, the ECB’s chief economist backed up his president’s view saying that rate rises would need to continue for some time.

Although there were some positive signs with the Eurozone economy expanding by 0.3% over the third quarter, ahead of expectations, the comments from the ECB were broadly in line with their colleagues at the Fed with chair Jerome Powell stating that, “it will take substantially more evidence to give confidence that inflation is on a sustained downward path.” The response from markets was rapid and fierce; the main index in the US had its worst day since the start of November while Europe’s equivalent market was down 2.8% for its biggest drop since May.

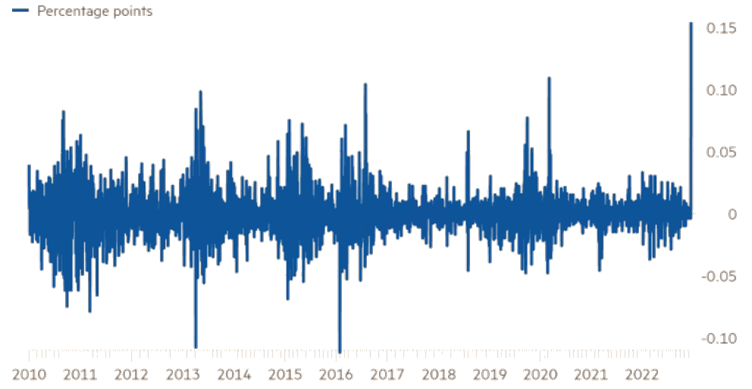

A few days later the second shock came from another central bank (as so often seems to be the case), this time in Japan. In what could well be the final act of the outgoing governor of the Bank of Japan (BoJ), a very small change was made to something called ‘yield curve control’. Whilst the act itself represented only a minor alteration to the existing monetary policy, its implication is that the BoJ is planning to begin to tighten its current ultra-loose approach.

Given that most other major central banks have already made moves to tighten policy this outcome is not that surprising, but the timing is and as ever it is surprises that markets don’t like. Much like in Europe, the Japanese economy had a better-than-expected Q3 GDP reading of -0.8%, however, the focus was on the implication for bond markets from the change in stance and it caused a huge spike in local government bonds.

Daily change in Japanese 10-year government bonds

Source: FT.com

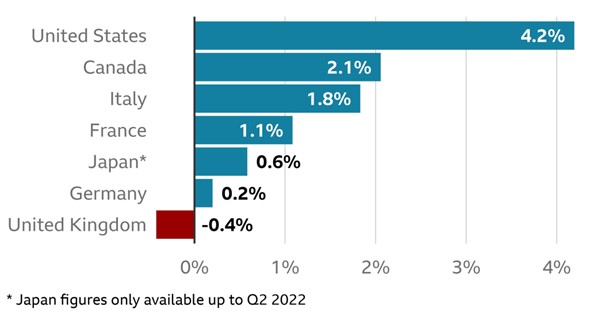

In terms of GDP surprises, the UK was the outlier with the -0.3% reading for the third quarter worse than the -0.1% that had been forecast. Whilst October’s data was more robust, the Q3 number left growth in the UK below the level it was at prior to the outbreak of Covid and meant that we were the only one of the G7 group of leading economies that saw GDP decline over the last three years. This concerning situation was echoed by data on household spending which showed that over the same period British consumers spent 3.2% less than they did before the pandemic struck which was the third largest fall of any of the 43 countries (including all of the G7) to have reported data for the quarter.

GDP growth from Q4 2019 to Q3 2022

Source: BBC/OECD

It is perhaps unsurprising, therefore, that the UK is predicted to have the deepest and longest recession out of the G7 based on a poll of 101 UK-based economists conducted by the Financial Times. The lingering impacts of Covid combined with the war in Ukraine are factors that have affected every member of the group, but the respondents also highlighted that these issues would persist longer in the UK with more than 25% of those polled saying that Brexit would continue to be a drag on growth along with the effects of persistent industrial action and political instability.

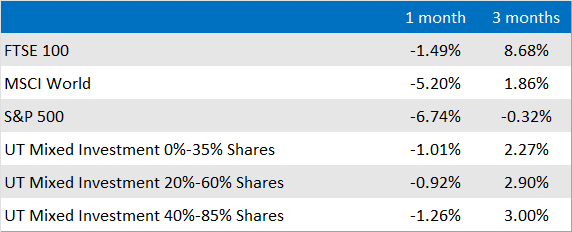

Interestingly, despite all this the UK’s main index, the FTSE 100, was the world’s best performing major stock market across 2022 and in fact was the only big one to register a gain for the year. As we’ve covered before in these updates, the FTSE 100 has a significant weighting to things like oil companies and arms manufacturers which clearly had a strong 12 months. Whilst the lack of big tech firms as seen in the US and China is usually a headwind, this preponderance of so-called traditional companies did act as a defensive barrier against the inflation and interest rate shocks (or should that be “shocks”?).

Speaking of China, they have relaxed some of their strictest COVID-19 rules meaning that citizens can now travel more freely and quarantine at home rather than in state-run facilities, while whole neighbourhoods or cities will no longer be locked down. This has seen many countries put in place additional checks for those travelling from China and has seen some terrifying predictions about the potential for high mortality rates, but the abandonment of the previous zero-Covid policy following some of the largest protests seen in decades paves the way for a re-opening of the world’s second-largest economy.

I am aware that the tone of this update has so far been… a little less than upbeat, but hopefully you will appreciate my preference for being honest about the challenges rather than trying to sugar coat them. There are some bright spots on the horizon, specifically in connection to the point above about the negative reaction to rising interest rates. It is looking much more likely that the falls in inflation that started to be seen at the end of last year were not false positives and if this is the case it should mean that the world’s major central banks will be able to bring to an end their current programme of interest rate rises at some point this year.

As an illustration of this, when the BoE raised rates at its meeting in December, 6 of the 9 members voted for the rise of 0.5%. This was notable both because that was a smaller rise than the 0.75% we saw in November and because at the previous meeting the vote was 7-2. More importantly, in November the minority of two both voted for increases, but at a lower level, while in December two of the three who disagreed with the majority view wanted to see no change to rates at all. This indicates that all members have shifted to a more cautious view as they attempt to ensure that they don’t overplay their hand in connection with the aforementioned recession. As we saw last year, making predictions is somewhat of a fool’s errand, but should this theme be echoed in other central banks it could well create more clement conditions for world markets in 2023.

Market and sector summary to the end of December 2022

Source: Financial Express Analytics.

Past performance is not a guide to future performance, nor a reliable indicator of future results or performance.