Thank you to everyone who has already responded to the latest review of the IMS portfolios which was sent out last month. We’ve had an excellent response so far, but if you have not yet had an opportunity to send us your acceptance, we would be grateful if you could so that we can make sure your investments are in the latest fund selection. You can respond to this message if you would like another copy of the review to be sent to you.

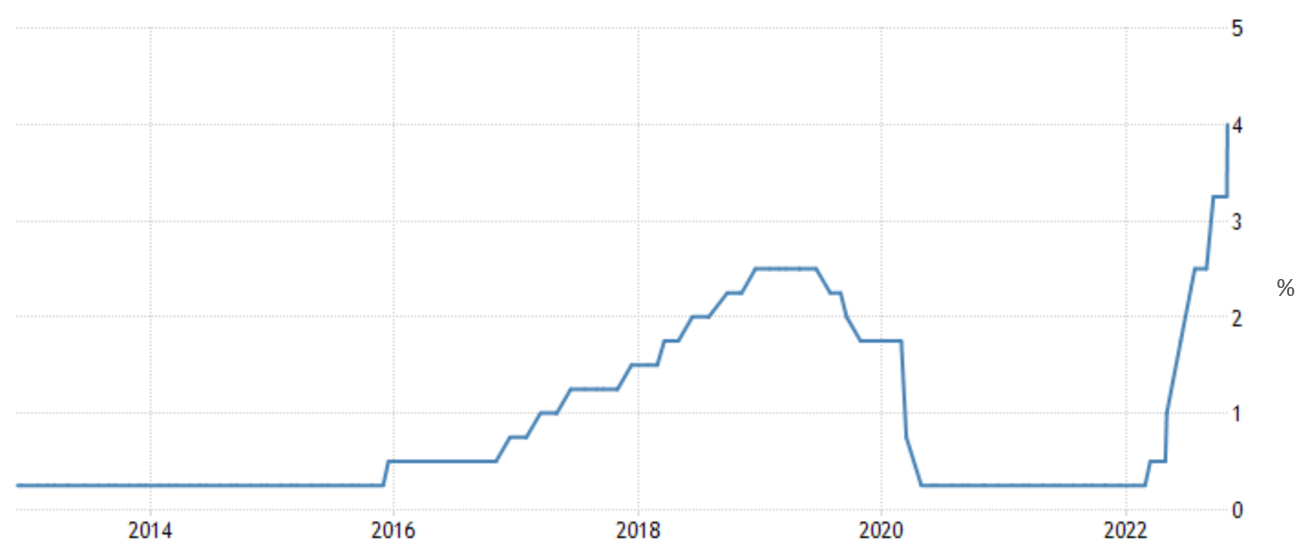

In the update that accompanied the review I highlighted the factors that had been dominating markets, with the actions of the US Federal Reserve (Fed) being one of the key ones. Very early in this new quarter it raised rates again, making its fourth straight 0.75% hike and the sixth rise in a row. There continues to be much debate about how many interest rate rises are still to come and the rhetoric that accompanied this latest increase indicated that further rises would follow as the rate setters attempt to bring inflation under control.

US Interest Rates

Source: tradingeconomics.com

Despite this, the reaction by markets a little over a week later to the news that US inflation was 0.3% lower than expected in the 12 months to October might suggest that they are confident that the Fed is already approaching the end of its current raising cycle. On the day that the headline inflation rate was reported as rising by 7.7%, the main US indices had their best day for more than two and a half years in a remarkable rally that was echoed by markets around the world.

It would be a brave prediction to suggest that this is the beginning of a new bull market, but it is precisely rallies like this which lead to phrases like “time in the market, not timing the market”; rallies are often strongest at the end of a downturn and missing out on them can have a big impact on long-term returns.

It's important to point out that while this is not the first time that we’ve seen a market spike on better-than-expected inflation data, we have also seen the opposite happen. Investors are wary of missing out and given some of the movements out of equity markets that we’ve seen this year, there have been signs that investors have been taking advantage of share price falls to invest some of the cash they’ve built up. However, a recent survey by Bank of America suggests that fund managers are still very defensively positioned with cash weightings only slightly below the 20-year high that was hit in October. They will be keen to pick up companies at low prices, but there will inevitably be further bumps in the road until we start seeing interest rates flatten out in reality rather than prediction.

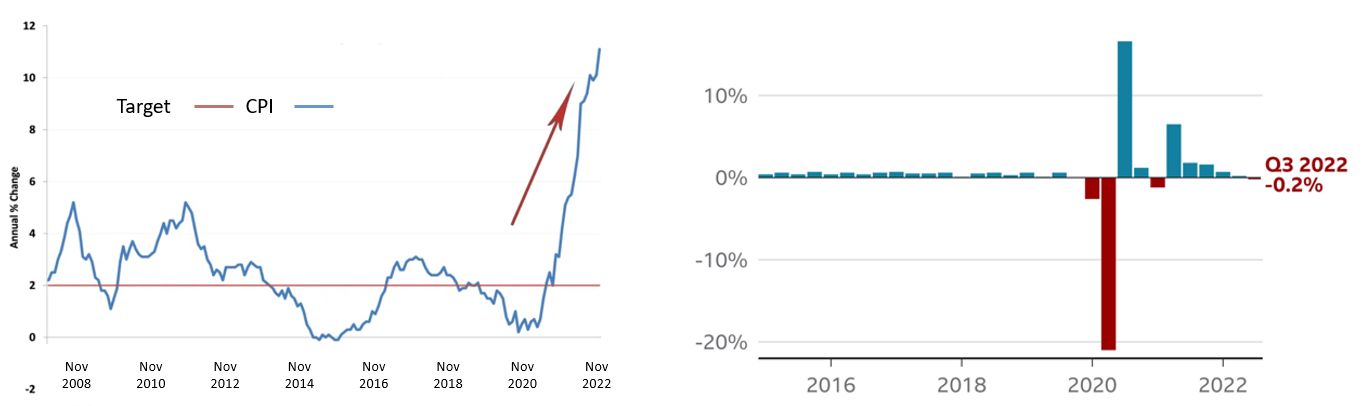

While UK markets shared in the bounce, the focus quickly returned to economic signals which are not looking so rosy. Inflation was revealed to be 11.1% in October, already ahead of the Bank of England’s (BoE) prediction that it could rise as far as 11%, and it was also confirmed that GDP fell by 0.2% in the third quarter, deepening fears that we will soon find ourselves in the long-predicted recession.

UK Inflation and GDP

Source: ONS

The Q3 drop was largely down to the 0.6% fall we experienced in September with the additional bank holiday for the Queen’s funeral further reducing productivity. With the aftermath of the disastrous mini-budget overlapping with the start of the final quarter we are all but guaranteed to see another fall that sends us into a recession that the BoE has predicted could last until the middle of 2024.

As noted in his recent Autumn Statement, Jeremy Hunt believes the UK is already in a recession. He unveiled a raft of measures designed to keep this as short and shallow as possible but we’ve seen attempts to manipulate economic downturns before and usually they are about as successful as trying to control the weather.

Truss and Kwarteng’s economic experiment may have been quickly unwound by the new chancellor but its impacts cannot be so easily erased. Having been lauded at the time as a “true Tory budget”, the resulting rise in borrowing costs and other related expenditure has added an estimated £30bn to the fiscal black hole that Hunt is attempting to fix. With the Office for Budget Responsibility forecasting that a weakening economic outlook will ramp up government debt to as much as £100bn as the tax take shrinks, he will need to balance filling the hole while trying to avoid making the impending economic downturn deeper than it is already predicted to be.

The structural issues we face will only make the challenge harder with the OECD recently predicting that next year the UK will be the worst performer out of every member of the G20 bar Russia. There has been a lot of talk recently about some pretty radical solutions with the head of the CBI wanting to see immigration rise to help boost productivity (a view that is apparently shared by the chancellor) and the government has been forced to deny that discussions are being had about a potential Swiss-style deal with the EU.

Both of those points are very much connected and signs of the challenges facing post-Brexit Britain don’t come much more symbolic than losing our title as the largest stock market in Europe to France following recent sterling weakness. Many people, including an increasing number of Tory MPs, are coming around to the idea that we might need to spend a bit less time rearranging deckchairs and focus instead on patching up the rather obvious iceberg-shaped hole.

Market and sector summary to the end of November 2022

Source: Financial Express Analytics.

Past performance is not a guide to future performance, nor a reliable indicator of future results or performance.