It’s not often I cover the details of a budget in these updates as they don’t usually have a direct impact on our investments, but it’s safe to say that the policies announced by the new chancellor were not especially well received outside of a very small group of high earners and business leaders. Kwasi Kwarteng’s fiscal event led to an immediate fall in local indices and saw sterling hit an all-time low level versus the US dollar.

The dollar has been on a strong run for much of the year as concerns about the economic outlook led investors to seek out a safe haven and this had caused sterling to weaken in response, but the falls as Kwarteng gave his speech on Friday morning were dramatic and weren’t limited to just the dollar.

Sterling plummets

Source: www.xe.com / Daily Telegraph

Perhaps more concerning for the UK economy, the other impact was to borrowing costs which have risen to the highest level since 2008, some nine times higher than the rate from this time last year. At a headline level, the new borrowing necessitated by the proposals (resulting from the initial drop in taxes paid to the Treasury) will result in an additional £45bn of debt and as this gets more and more expensive, the faster our debt pile will grow. Markets are concerned at this rapidly rising borrowing and the gamble that the Treasury is taking with its “unapologetically” pro-growth proposals. Kwarteng’s plans were unaccompanied by the usual impact assessments and as such it is difficult for investors to understand the scale of the bets being taken, or even if the chancellor himself is aware of them.

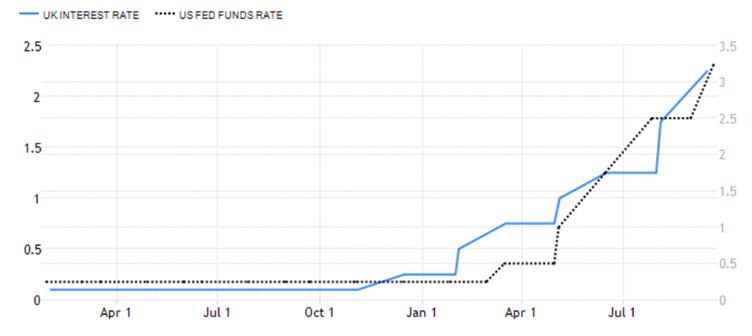

Such was the strength of the reaction that there was even speculation that the Bank of England (BoE) might need to hold an emergency meeting in order to stabilise markets. In the end they resisted the temptation but they did step in with a £65bn intervention to shore up pension funds which came under pressure after rapid movements in bond markets. The bank’s Monetary Policy Committee had only met one day before the tax cuts were announced to agree a 0.5% increase to base rates. The hike was smaller than many analysts had expected given the pressure of rising inflation and the committee members were split on how firm to be – five of them opted for the 0.5% move while three wanted it to be 0.75% and one opted for just 0.25%. The BoE’s decision was announced not long after the Federal Reserve (Fed) made yet another 0.75% rise, their third in as many meetings, which takes the rate to highest level since 2008.

Rising Rates

Source: tradingeconomics.com (UK LHS, US RHS)

With inflation in the US sitting at a 14-year high, the Fed’s chair painted a gloomy picture while suggesting that it was likely that we’ll see another large hike before the end of the year. Whilst the ramifications for the UK economy of the government’s focus on hitting 2.5% GDP are yet to be fully understood, more broadly, markets are concerned that the ongoing push to raise interest rates will be harmful for economic stability and bring forward a global recession, fears of which have been stalking markets all year.

One factor that encapsulates the concern in the market is the fall in oil prices. Having jumped back above $120 a barrel following Russia’s invasion of Ukraine, prices have been tracking lower since the middle of the summer as forecasts of demand are reduced. Early in September, OPEC and its partners controversially agreed to cut the supply of crude oil in order to lift prices. The cut was small in the grand scheme of things (100,000 fewer barrels per day, the reverse of the increase they made recently) but the move was described as having a political dimension given Russia’s inclusion in the negotiations.

Oil prices on the way back down

Source: BBC / Brent Crude oil futures

With prices dropping back below $90 per barrel for the first time since Russia's invasion, Opec’s decision could equally be seen as a sensible defensive move as they look ahead. One of their concerns is China’s continuing zero Covid policy which leads to entire regions being locked down. In addition, an ever-stronger US dollar is creating a headwind for emerging market countries as it makes it harder for them to pay back debt which could hamper their growth, therefore lowering demand. Opec meet again this week and we’ll be closely watching the outcome of their discussions.

As we headed into the final month of the quarter, I found myself, not for the first time, relieved that I do not have to make changes more frequently given the fast-moving nature of markets in recent weeks. This may sound counterintuitive, but it means that we aren’t trying to react to short-term information and it allows us to focus on the medium to longer term impact of events without the pressure to “just do something”. It is always the case that a diversified range of assets will not perform as well as individual sections of the market, but the challenge is knowing which sections to focus on at any given time. Naturally this involves an element of gambling and, unlike Kwasi Kwarteng, this isn’t something that we like to engage in.

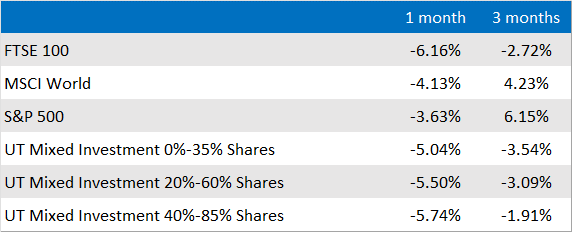

Market and sector summary to the end of September 2022

Source: Financial Express Analytics.

Past performance is not a guide to future performance, nor a reliable indicator of future results or performance.