It would be nice to be able to start this, the first update of 2022, without mentioning the pandemic, but with the Omicron variant proving to be one of the most contagious, it remains a dominant theme as we enter the new year. That being said, despite the huge number of infections in this latest wave, the evidence is that the symptoms are less severe and although hospital rates have risen, they are not at the levels seen at the peak.

It is for this reason that the Prime Minister has resisted a return to harsher restrictions for England unlike the devolved nations, as well as much of Europe. Boris Johnson is pinning his hopes on the fact that the current mass of absences, in both the NHS and elsewhere, will be temporary. Hopefully this strategy will prove to be the right one and with medical experts cautioning that we cannot vaccinate the entire world every 6 months, the weakening strength of the virus could mean that we’re approaching the point where we learn to live with it.

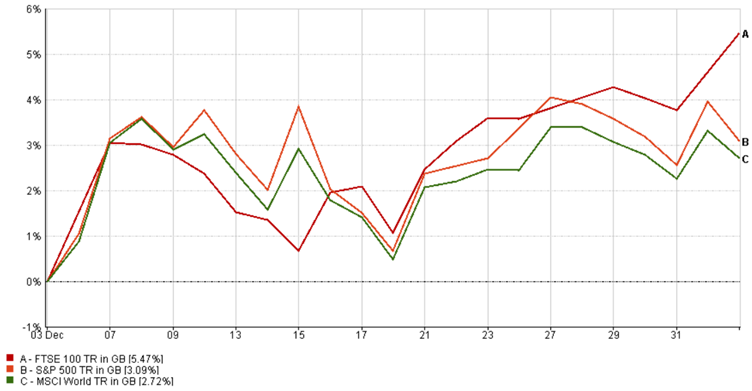

As ever, if you looked only at market performance, you could be forgiven for thinking that Covid had indeed ceased to be an issue. Most major indices were up over the month with the FTSE 100 reaching its highest point since the start of 2021 and several, including the S&P 500, finishing the year at record levels. Over the holiday period many markets enjoyed their traditional “Santa rally”, the period around Christmas where markets tend to enjoy a boost. Statistically it is the period during which the S&P 500 index is most likely to produce a positive return versus any other time of year.

Santa Rally

Source: Financial Express Analytics (03/12/2021-04/01/2022)

As covered in previous updates, much of the rise in the US came as a result of the extraordinary growth of the “Big Tech” companies. Forefront of these is Apple and its growth over the last 12 months helps provide some context for the sector. The company started 2022 by becoming the first company to be valued at $3tn after its value rose by more than 30% over the previous year, with over £500bn added since November alone. The company passed the $2bn point in August 2020 and was the first to hit $1bn just 2 years before that. The challenge for investors is whether to back the company to continue to grow, or to identify the next generation of companies which might take Apple’s crown at some future point.

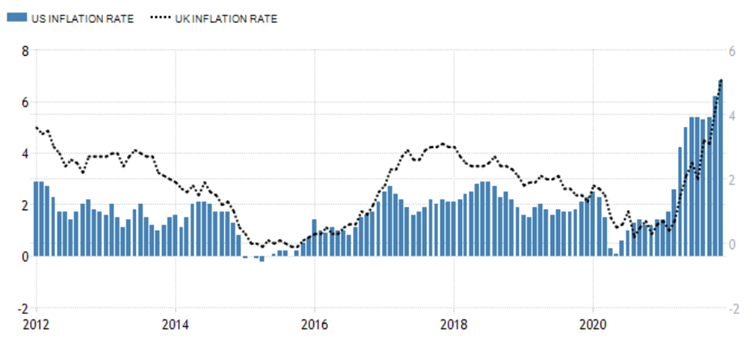

The other main theme of 2021 was very much in evidence in December as central bank (in)action had market forecasters reaching for their erasers. First, some background: inflation in the US hit 6.8% in November, the highest point for nearly 40 years, while in the UK the rate was 5.1%, up from 4.2% in October. For much of the last year central bankers repeatedly insisted that inflation was transitory but with the data increasingly suggesting otherwise, who were they trying to fool – investors or themselves?

Peaking Prices?

Source: tradingeconomics.com

Despite an awareness that the leap in fuel prices would eventually wash out of the data, the corresponding impact on services and manufacturing is still taking effect, leading to a softening of their rhetoric. At the Federal Reserve (Fed), towards the end of the year chairman Jerome Powell eventually stated that he would like to retire the word “transitory” leading many people to assume that the Fed would be the first bank to push the button on interest rates but their final meeting of 2021 came and went without any announcement.

Then, on December 16th, the Bank of England surprised quite a few forecasters when it became the first major economy to increase interest rates. The scale of the rise was in line with expectations, with the rate increasing by 0.15% to 0.25%. Local markets were broadly pleased with the decision even if it is unusual for the US not to take the lead. For their part, the Fed have said that they are deferring the decision while they focus on increasing the rate at which they cut their stimulus purchases, with the intention to reduce them by $30bn rather than $15bn each month. This would mean that they would finish the process ahead of schedule around March, potentially leading to several rate rises later in the year.

From an economic perspective, both countries enjoyed a positive third quarter but with a sharp drop off from the previous period. In the US, GDP hit 2.3% to the end of September well below the previous 6.7% while in the UK the rate fell from 5.4% to 1.1%. In Europe the rate of 2.2% matched the figure from the quarter before. Expectations are mixed about what the final quarter of 2021 will have been with the US looking most likely to see strong growth as restrictions in Europe continued to bite.

I hope you all had an enjoyable and relaxing festive period and, as we enter this new year, you will join me in looking forward to a brighter future. Indeed, with self-driving cars being tested in the UK and Denmark planning on green air travel by 2030 it is starting to feel like we are moving towards the sort of world that movies have promised us for so long. A focus on looking forwards rather than back will also be key in 2022; it seems unlikely that we’ll see returns at the scale we enjoyed over the previous 12 months with inflation remaining high, interest rates beginning to rise, and the bulk of the pandemic recovery already banked. However, none of these factors are unprecedented and investing for the long term, especially in equities, is very likely to remain the best strategy.

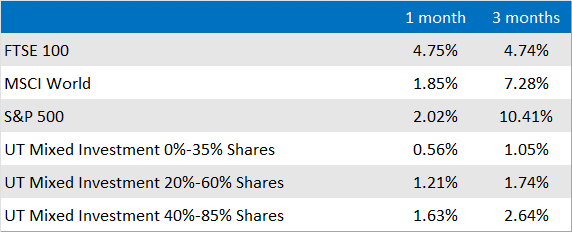

Market and sector summary to the end of December 2021

Source: Financial Express Analytics.

Past performance is not a guide to future performance, nor a reliable indicator of future results or performance.