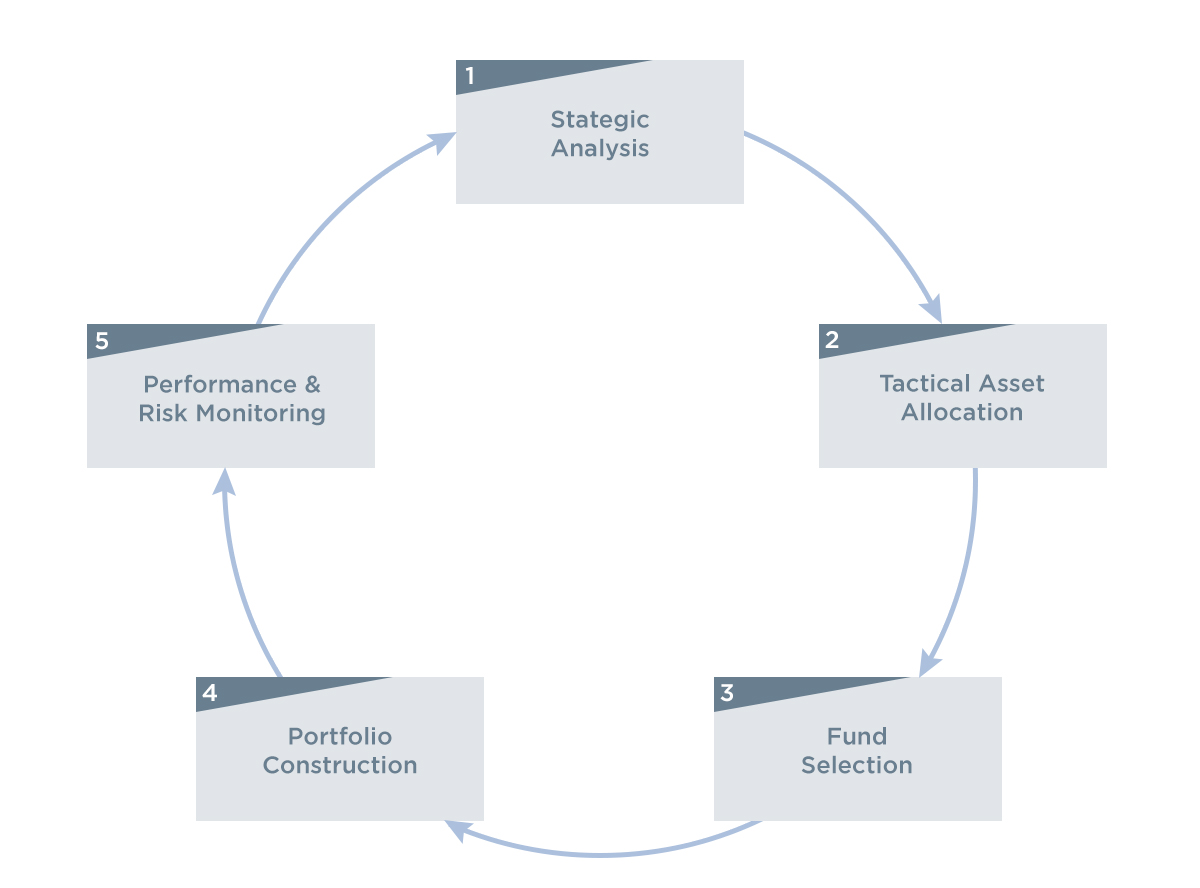

IMS Process

1. Strategic analysis

The basis to each of our portfolios stems from a third-party asset allocation model which ties in with the risk assessment questionnaire. This strategic asset allocation gives a guideline breakdown of which geographical regions or sectors should be allocated holdings given set levels of risk.

2. Tactical Asset allocation

In conjunction with the strategic analysis our investment committee meets to decide which geographical regions should be given a higher or lower allocation based on its predictions for the coming period. This part of the process provides a large proportion of the added value for the portfolios.

3. Initial Fund selection

The committee starts by looking at the relative performance and risk of entire subsets of funds (e.g. UK equities) and uses a series of ranking systems to narrow the funds to a shortlist. This allows a vast number of funds to be efficiently peer reviewed.

4. Portfolio construction

In line with any asset allocation changes or fund sale requirements the committee uses shortlists to investigate which funds are most suitable. This will include research to establish investment procedures and financial stability as well as more detailed examinations of risk adjusted performance.

5. Performance and Risk Monitoring

Each portfolio is reviewed quarterly and the underlying asset allocation is revised to ensure it remains broadly in line with the strategic view whilst incorporating any tactical modifications. Afterwards the underlying funds are reviewed to ensure ongoing suitability and recommendations made to adjust the portfolio accordingly.